Working Capital Loan For SMEs: 5 Essential Questions To Ask When Taking One

Have you ever considered taking a business loan to meet the financial needs of your Small and Medium Enterprise (SME)? If yes, you probably have heard of working capital loans for SMEs.

In short, working capital is the money companies use for daily operational expenses. Managing your working capital properly can be challenging for an SME. As such, you might have to sometimes turn to taking a loan to meet your company’s financial needs.

While this sounds relatively straight-forward, there is quite a bit to consider before taking a working capital loan. If you do not ask the right questions, your working capital loan decision could end up doing more harm than good.

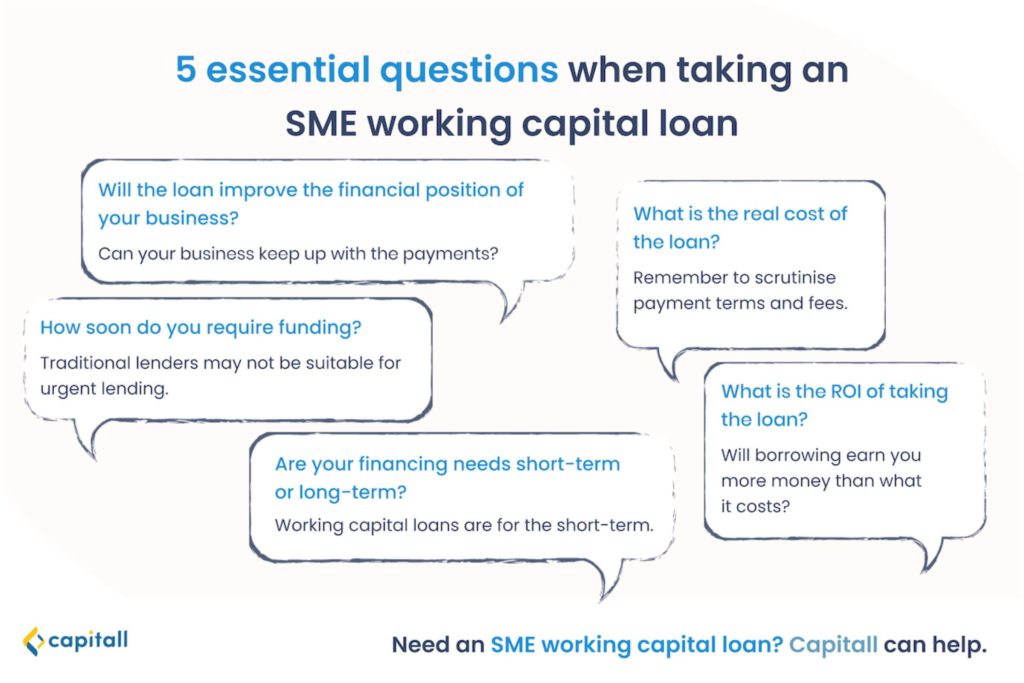

In this article, we look at 5 important considerations to help you make the right decision.

5 Questions To Ask Before Taking A Working Capital Loan For Your SME

1. Will The Working Capital Loan Improve The Financial Position Of My SME?

Some loans have heavy repayment fees. Merchant cash advances, for example, may require you to make daily repayments, and it can be difficult for you to pay this type of loan off.

Instead of improving your situation, taking an unsuitable working capital loan might deteriorate the financial position of your business. This is especially so if you land yourself in a debt spiral to pay off previous loans.

That is why it is important to always consider the costs and benefits of the loan. Before taking a working capital loan for SME, make sure your business can keep up with the repayments.

2. What Is The Real Cost Of The Loan?

Some business loans have hidden costs that can often be overlooked. As such, it is important to clearly understand the clauses and repayment terms first.

Look out for terms that allow for change in the interest rate for the SME working capital loan, or loan acceleration clauses. Some working capital loans for SMEs have interest rates that are prone to changes. You won’t want to take out a loan only to realise that the costs and terms are different from what you expected.

Always scrutinise payments terms and fees before applying for a working capital loan for your SME.

3. How Soon Do I Need The Working Capital Loan For My SME?

Traditional lenders can take up to a few weeks before your loan is approved. If you need the funds urgently, getting a working capital loan from banks might not be for you. For example, you might need the money to fix some equipment urgently, or to tide over an unforeseeable situation.

As traditional lenders generally have more stringent application conditions, they can take longer to process applications. This means that they might not be suitable for urgent lending.

If the funds are for an emergency, you can consider approaching non-bank lenders instead such as Capitall.

4. Are My SME Financing Needs Short Or Long-Term?

Whether your needs are short- or long-term affects the type of financing you should go for. Working capital loans for SMEs are meant for short-term obligations, not long-term investments.

If you have long-term business financing requirements such as investments for long-term growth, a working loan won’t be a good fit for your business. Taking a loan that will serve the long-term financial needs of your business will be more beneficial to your company.

5. What Is The ROI Of Taking The Working Capital Loan For My SME?

Before taking a loan, understand the Return on Investment (ROI) of the working capital loan. Does it fit your current situation and needs? And more importantly—is it worth it? If borrowing the loan will not earn you more money than what it costs, it will be wise to rethink the loan.

How To Increase Your Chances Of Success For Your SME Working Capital Loan Application

The process of applying for a loan for your SME can be daunting. Thankfully, there are some ways to increase your chances of success.

Now that you have a clearer idea about your decision to take a working capital loan, here are some tips on how to increase your chances of a successful working loan application:

1. Provide Good And Clear Reasons For The SME Working Capital Loan

Giving sound and clear reasons will help the lender assess if the loan will be suitable for your SME. If there are other better alternatives, the lender might suggest them to you instead.

To gain your lender’s trust and confidence, you should also clearly show how you plan to use the funds. It’ll be even better if you can demonstrate how the funds will contribute to your business’ growth and success.

You can also show a summary of your past successful projects. This will boost your SME’s credibility, indicating to the lenders that you are likely to use the loan to work towards similar successes.

2. Provide Healthy Bank Records

Having a clean bank statement will also help increase your success rate. This means that your bank statement should reflect regular deposits, a healthy bank balance, and no overdrafts. All this signals to your lenders that you’re a reliable borrower with good management of your business finances.

Even if you have past overdraft records, that doesn’t mean your working capital loan application won’t be successful. You just need to provide background information on your situation (including the dates and account number) and explain why you need the funds.

You can communicate that your past overdraft record is a one-off incident, and elaborate on the measures you have in place to prevent similar incidents from happening again. This will help put your lender at ease.

3. Show Evidence That Supports Your Projections For Cash Inflow

When your lenders review your cash inflow projections, they will want to assess how realistic your plans are. Lenders are naturally afraid that borrowers will lose the money through unrealistic business plans, and therefore be unable to meet the loan repayments.

Lenders will also want to know if there’s still some leeway when it comes to your loan. That means that if unforeseen expenses crop up, they want to know that you can still meet the loan repayments.

It is therefore important to submit documents showing evidence that you can support your cash inflow projections. This includes recent invoices, aged list of debtors, evidence of confirmed orders, and updated management accounts and transactional data if you run a B2C business.

4. Beef Up Your Personal Credit Score

If your SME has not established a business credit history or doesn’t have a good one, your personal credit score will be used to assess your loan application. This is because your personal credit score is an indicator of your financial management.

Business owners with a good personal credit score are often perceived to be responsible and reliable. You should therefore ensure that you have a good personal credit score.

If you are planning to borrow from a bank, you can check with the Credit Bureau of Singapore (CBS) for more information about a bank’s lending decision.

It would also be beneficial for your business if you meet your SME loan repayments on time and consistently. This will increase your business credibility and build a good credit history for your SME.

5. Consider Alternative Lenders

As mentioned, banks aren’t the only option out there to get a working capital loan for your SME.

Not only are the working capital loan applications typically processed faster by non-bank lenders, they may also be more flexible in the approval of your working capital loan. With Capitall, you can receive your business loan within 24 hours.

| Ways to increase your chances of a successful working capital loan application | Why? |

| Give good justifications for taking out the working capital loan | Gives the lender confidence that the loan will be put to good use, and that you’ll be able to eventually repay it. |

| Provide clean bank records | Demonstrates good management of finances |

| Provide evidence for cash inflow projections | Shows that your business plans are realistic |

| Improve your personal credit score | Your personal credit score is a reflection of your financial management competence |

| Consider non-bank lenders | You might have a higher chance at a successful loan application. Processing time is also usually faster. |

All in all, do remember to consider the 5 essential questions shared when taking a working capital loan for your SME. If you prefer not to take a loan from a bank, there are still non-bank lenders such as Capitall that you can consider.