Business Loan In Singapore: How Can A Business Line Of Credit Help Your SME?

As a business owner, you probably have had your fair share of experiences managing tricky financial situations. Finding yourself in a position where your business finances are not enough to cover operational expenses can be daunting. In times like this, turning to a business loan in Singapore can be useful. A business line of credit, in particular, is one of the most popular options businesses look into to handle the day-to-day cash flow.

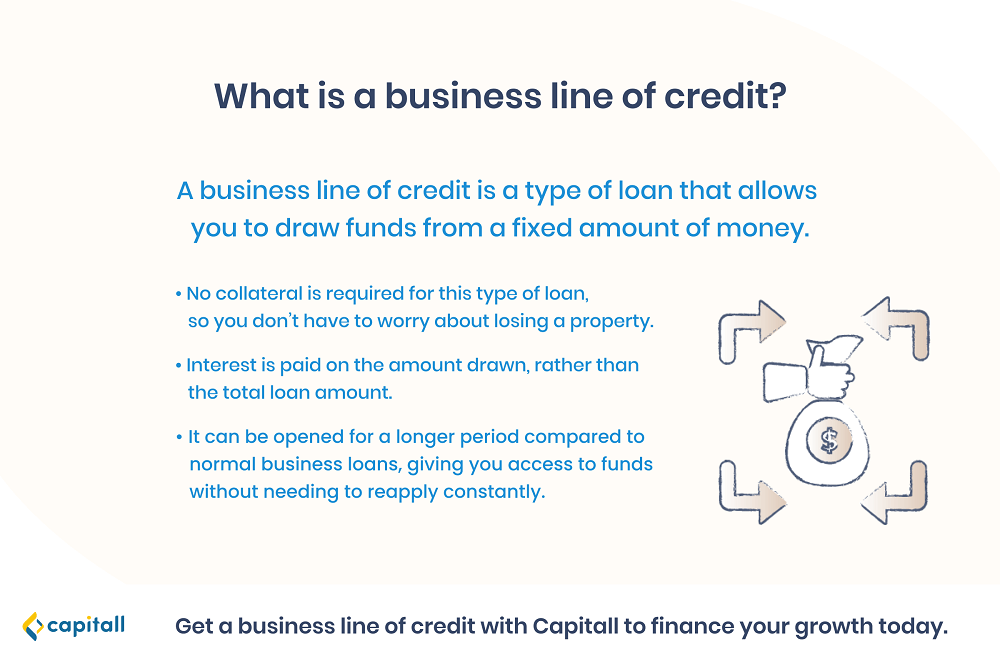

What Is A Business Line Of Credit?

A business line of credit is one of the short-term working capital loans we covered in this article.

To put it simply, a business line of credit functions similarly to a personal credit card. It is a revolving loan that allows borrowers to draw funds from a pre-approved sum of capital anytime.

It is unique from other forms of business loans as interest will only be charged when you draw an amount from the account. A monthly statement reflecting the amount of credit used will also include the interest charges.

For example, if you draw S$10,000 in February, the monthly statement will include the interest percentage of that amount. And if you draw S$5,000 in March, the interest charged that month would be a percentage of the S$5,000.

Once you have repaid your monthly statement, the credit limit will be reverted to the full amount for you to access again.

How Can A Business Line Of Credit Help Your Business?

Getting a business line of credit can come in handy, especially if your business frequently requires quick access to cover daily expenses. Here are some ways a business line of credit can help you:

1. Cover Short-term Expenses

There will inadvertently be times where you will face unforeseen circumstances when running your business — for example, needing extra capital to overcome seasonal fluctuations or to cover cash flow gaps.

When such instances occur, a business line of credit will come in handy to settle these short-term expenses while you concentrate on the bigger picture.

2. Flexibility In Your Spending

Taking a business line of credit loan in Singapore makes it easier for you to spend according to your business needs, as there is no minimum amount for you to take out, and you can do so at any time.

A business line of credit provides you the flexibility to make repayments on interest charges based on your needs. As long as you make the repayments on time and have a good grasp on your available credit limit at any one time, it is a convenient way to access extra funding.

3. Quick Access To Funds

As a short-term loan, getting a business line of credit can be quick and easy. This allows you to fill up immediate financial gaps and allocate your time on more important business matters. In fact, you can get a business line of credit as fast as within 24 hours with Capitall.

4. Financing Recurring Expenses

Also, a business line of credit can help business owners maintain a constant supply of cash to keep up with recurring expenses.

These recurring expenses could be your office rent, utilities, office supplies, and software needed for daily operation.

How To Qualify For A Business Line Of Credit

Similar to other business loans, qualifying for a business line of credit differs across financial institutions. Most traditional lenders, such as banks, usually require businesses to have substantial revenue and at least a few years of history to qualify. Private financial institutions, on the other hand, have a more lenient take on the requirements.

| Banks | Private Financial Institutions | |

| Minimum annual turnover | At least S$300,000 | At least S$100,000 |

| Operational history | At least 2 – 3 years | At least 10 months |

| Registration | Singapore registered company | Private Limited Company registered with ACRA |

| Ownership | 30% – 50% local ownership (Citizen/PR) | One of the directors must be a Singaporean / Permanent Resident or foreigner residing in Singapore. |

| Loan Tenure | 4 – 5 years | Varies based on the type of business loan |

| Interest rates | Varies based on risk level determined by the banks | Varies depending on your business profile and credit analysis |

Benefits Of A Business Line Of Credit

It is always good to have extra funding to fall back on, regardless of your business situation. Having a business line of credit can help your business, whether it is for emergency needs or to use it as a safety net for timely investment opportunities.

1. It Is An Unsecured Loan

An unsecured loan is a type of loan that is not backed by any asset. It is solely supported based on the borrower’s creditworthiness. With a business line of credit, you do not have to worry about having to put up collateral or losing a property in case you cannot pay the loan on time.

That said, there are cases where collateral may be required for more extensive lines of credit. However, most financial institutions in Singapore only offer a small line of credit. Thus, it is unlikely that you need to put up any collateral backing for a business line of credit in Singapore.

2. It Only Charges Interest Based On The Amount Used Rather Than The Total Loan Amount

In essence, you only need to pay for what you withdraw, and the interest is only charged based on the amount drawn. This gives you the flexibility to decide the amount you need at any given point and manage your financial spendings.

3. It Can Be Opened For A Longer Period Compared To Other Business Loans

This gives you the advantage to have funds for your business consistently, without needing to reapply.

Cons Of A Business Line Of Credit

Where there are benefits, there will undoubtedly be a couple of drawbacks.

1. There Could Be Relatively Higher Interest Rates

As the interest rate for a business line of credit is charged based on the amount drawn, you should only borrow what you need and not risk overdrawing. Doing so will result in high repayment amounts that stem from the high interest rates incurred.

2. Unsecured Business Line Of Credit Has Lower Credit Limits Than A Term Loan

Credit limits on an unsecured business line of credit could range anywhere from S$1,000 to S$250,000.

As you are drawing from a pre-approved amount, you cannot exceed that credit limit. In situations where you need more than the agreed amount, you may need to revise the loan terms or apply for another business loan.

What To Take Note When Looking For A Business Line Of Credit

If you are considering a business line of credit, here are some points to keep in mind when comparing your options to find the right line of credit loan for your business.

1. Affordability

Understanding if your business can afford to support a business loan should always be the main consideration.

Before taking out any type of debt, make sure to calculate all the associated costs and ensure that the business cash flow can cover the monthly repayments.

2. Costs

Besides the interest rate, check for other chargeable fees such as application, processing, or late repayment fees.

Some financial institutions may also charge ongoing fees like loan service and annual fees. It is good to be aware and have a clear understanding of these fees.

3. Verification

A legitimate private financial institution will always go through the loan terms with you in-person, before disbursing your approved loan.

If your lender disburses your loan into your business bank account directly without a face-to-face verification, it is a warning sign that your lender might not be operating legally.

A business line of credit is great for a growing business. Not only can it cover urgent financial gaps, but you can also tap into the funds whenever you need to take advantage of investment opportunities.