Is Merchant Cash Advance Suitable For Your Business?

As you try to secure extra funding for your business, you might have stumbled upon the term merchant cash advance. Clueless as to what it is? Here’s a lowdown of what it can offer.

A merchant cash advance is a form of short-term business funding that could serve as a lifeline for businesses that had previously failed to get the needed capital from banks or other financial institutions. Sounds familiar to a business loan? Don’t be mistaken, a merchant cash advance is not the same as a typical business loan.

What Exactly Is A Merchant Cash Advance?

While it can provide immediate working capital for your business, a merchant cash advance is different from a business loan in that the former is offered in exchange for a percentage of your credit or debit card sales, on top of an additional fee.

In other words, acquiring a merchant cash advance implies that you are allowing the lender access to your future earnings. This means repayment for that extra capital would be deducted from sales you receive from credit or debit card payments.

Merchant Cash Advance VS Business Loans

The difference between a merchant cash advance and a business loan mainly lies in how repayment is made.

Unlike in a business loan where repayment is made regularly within a stipulated period, repayment for a merchant cash advance is automatically withdrawn from a percentage of payments you receive from credit or debit card sales.

Based on how a merchant cash advance works, it would be most suited for businesses that derive revenue from credit and debit card sales — for example, cafes, restaurants, e-commerce retailers, or service shops.

Here’s a comparison table to highlight the difference between a merchant cash advance and a business loan:

| Merchant Cash Advance | Business Loan | |

| Suitable for | Businesses with the majority of payment received from credit/debit cards | Any type of business |

| Repayment method | Paid from a percentage of sales made through credit/debit cards only | Can be paid from funds received from various means |

| Repayment amount | Not fixed, depending on the amount of sales made | Usually regular fixed amount within the stipulated time frame |

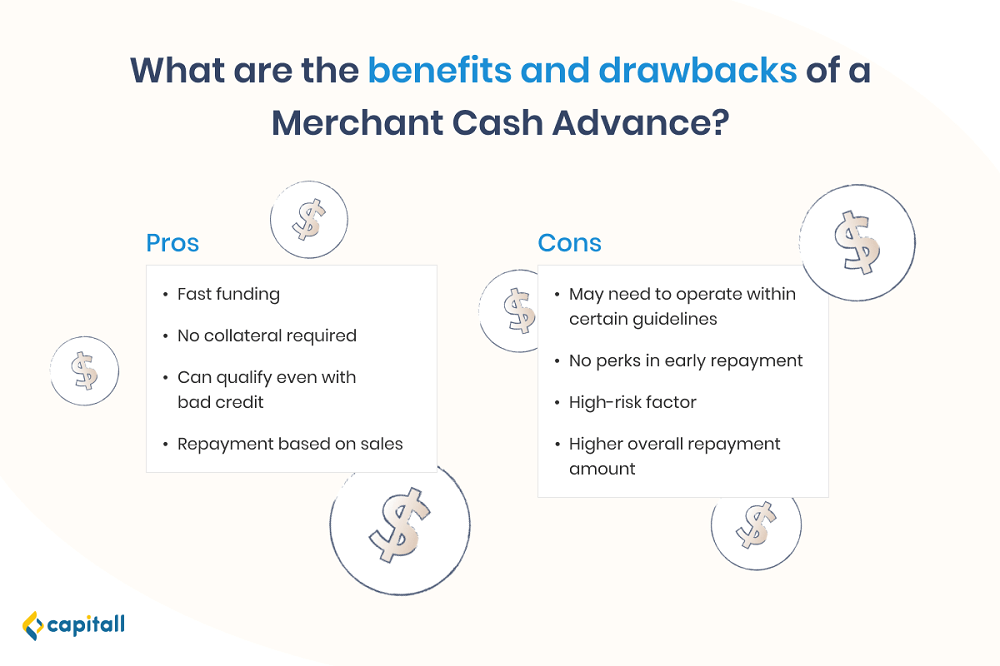

Now that we have a clear understanding of how a merchant cash advance works, let’s consider the pros and cons of this funding option. Understanding this would help you determine if it could help in your business.

Pros Of A Merchant Cash Advance

Getting a merchant cash advance could be a draw to small businesses in Singapore.

1. Fast Funding

Depending on the lender, the approval period could vary. But in general, the approval process for a merchant cash advance is usually quick and relatively hassle-free, as minimal documentation is required. You could get a merchant cash advance within a week if you meet all the application requirements.

To apply for a merchant cash advance, your business should meet the following eligibility criteria:

- ACRA registered for at least 24 months

- Be a private limited entity

- Have a corporate bank account

- Be registered with an accredited payment processor for at least 6 months

- Must be reputable, with cleared AML/KYC checks on board members

- At least 30% of the business’ shareholders are Singaporeans or PRs

2. No Collateral

Contrary to some belief, there is no need to offer personal or business assets as collateral to get approved for a merchant cash advance. This contrasts with some business funding options that require collateral as a security measure for lenders to recoup their costs, should the borrower fail to make repayments.

3. Can Qualify Even With Bad Credit

A bad credit score would be a thorny issue in applying for business loans, especially with banks.

If you are a business owner looking for a business loan but have a low business and personal credit score, you may consider private financiers like Capitall. They are more lenient and do not scrutinise your loan application based on your credit score.

A merchant cash advance is technically not considered a loan, thus having a less than perfect credit score would not adversely affect your application. In offering business cash advance, lenders are more interested in the consistency of your business making sales through credit or debit cards.

4. Repayment Is Based On Sales

The repayment amount is not fixed and could fluctuate depending on your business earnings from credit and debit card sales. As the repayment is deducted based on a fixed percentage of your sales, you would pay less if sales are lower, and more when you have a sales surge.

With a merchant cash advance, you don’t have to worry about being unable to pay back the amount owed, as lenders will just take the same percentage off your receipts as repayment. You could avoid getting caught in repayment difficulties, a common predicament faced by those with business loans.

As the lender automatically deducts repayment, you reduce, if not eliminate, the chances of incurring late charges, which could happen in repaying a business loan.

Cons Of A Merchant Cash Advance

While the pros of getting a merchant cash advance in Singapore could be a draw, you should weigh in on the following cons as well:

1. The Need To Operate Under Certain Guidelines

In offering a business cash advance, lenders might impose some guidelines on the way borrowers operate their business. This could open the way for lenders to have control over your business to a certain extent.

For example, lenders might include a term in the contract such that your business is prohibited from encouraging customers to pay in cash.

In addition, lenders could have jurisdiction over your business’ operational schedule. You might not be allowed to close the business for an extended period (e.g. month-long vacations) until repayment is fulfilled.

Should such terms be imposed and agreed upon between you and the lender, you could stand to lose some control over your business.

2. No Perks In Early Repayment

The factor rate, as predetermined by the lender, will apply regardless of how long you take to repay the advance amount. This means that there is no incentive even if you have the means to pay off the amount early.

3. High-Risk Factor

Getting business cash advance could potentially be a high-risk move, particularly for businesses in industries where sales are more volatile. If you are unable to pay off the advance amount owing to a lack of sales, you would need to look for alternative sources in making a repayment.

4. Higher Overall Repayment Amount

A merchant cash advance is a short-term funding solution with a payback period that usually does not last longer than 12 months. Having a short tenure means that it’ll be a rather expensive funding option for many businesses. You might be looking at a total repayment amount that could be higher than other alternative forms of business loans.

How Do You Know If Merchant Cash Advance Is The Right Funding Option For Your Business?

A merchant cash advance could help if your business needs an immediate injection of extra capital. However, it might not be the answer to all your business financial woes. So what kind of circumstances would a merchant cash advance fit into your business?

1. When Majority Of Payments Are Received From Credit/Debit Cards

Although merchant cash advance could benefit e-commerce businesses, retail shops, or restaurants, your business could qualify as long as the majority of payments are received from debit or credit cards.

The funds can be used as a short-term financing tool to solve your short-term cash issues such as inventory purchases or payment to suppliers.

2. Lacklustre Credit Score

In extending business cash advance, lenders are more interested in your business’ future revenue rather than your past business performance.

As such, a bad credit score has no bearing on your approval eligibility. In fact, for businesses with low credit scores, acquiring a merchant cash advance could be a more viable option than getting a business loan.

Additionally, you can rest assured that your business credit score will not be affected in any way.

Alternatives To Merchant Cash Advance

If your business needs that extra funding, but you are concerned about the disadvantages attached to a merchant cash advance, you might want to consider the following alternatives:

1. Short-term Working Capital Loans

A short-term working capital loan is an alternative option for businesses, including those that do not depend on credit card sales for their revenue.

In addition to lower interest rates, this loan offers repayment terms in fixed instalments. Unsecured short-term working capital means you do not have to provide any personal or business asset as collateral.

While lenders won’t bat an eye on the credit score when offering a merchant cash advance, your personal and business credit scores are one of the things banks consider before extending a short-term working capital loan. If you have bad credit, you may want to consider borrowing from a private financial institution instead.

Find out more about the types of short-term financing options here.

2. Asset-based Financing

Your business might be in its infancy. With the lack of a commendable track record, it might be challenging to get approval for an unsecured business loan. Similarly, a merchant cash advance might not be within your reach if you can’t produce proof of credit card sales.

Should you find yourself in these circumstances, you could consider trying for asset-based financing for your business needs.

This type of loan makes use of your personal or business assets like real estate property, machinery, or inventory as collateral. Lenders that offer asset-based financing place more value on the borrowers’ collateral rather than the company’s financial standing or revenue performance.

3. Invoice Financing

Invoice financing works by exchanging unpaid invoices for a short-term loan. Lenders usually provide funding of between 70% – 90% of the total invoices. Invoice financing would benefit businesses that have fulfilled obligations to their customers but have yet to be paid for their goods and services.

Rather than having your business operations compromised due to the long wait for payments, invoice financing is an option for its low-interest rate and speedy fund disbursement.

Getting A Merchant Cash Advance

A merchant or business cash advance has its advantage as a quick means of getting extra capital for your business. It has its drawbacks too, however. Thus, it is advisable to understand what these are and also to determine if your business is the right fit for this type of funding before you apply for one.