9 Things To Ask Before Getting A Business Loan In Singapore

Gone are the days when banks are the default go-to place in getting a business loan in Singapore.

Small and medium-sized enterprises (SMEs) these days have various options ranging from banks to private financial institutions that offer different types of business loans.

As your business grows, it would most likely need more financing to expand areas such as operational costs, manpower, equipment, or marketing.

With the different types of business loans out there, how can you streamline the process of securing the funds needed for your business?

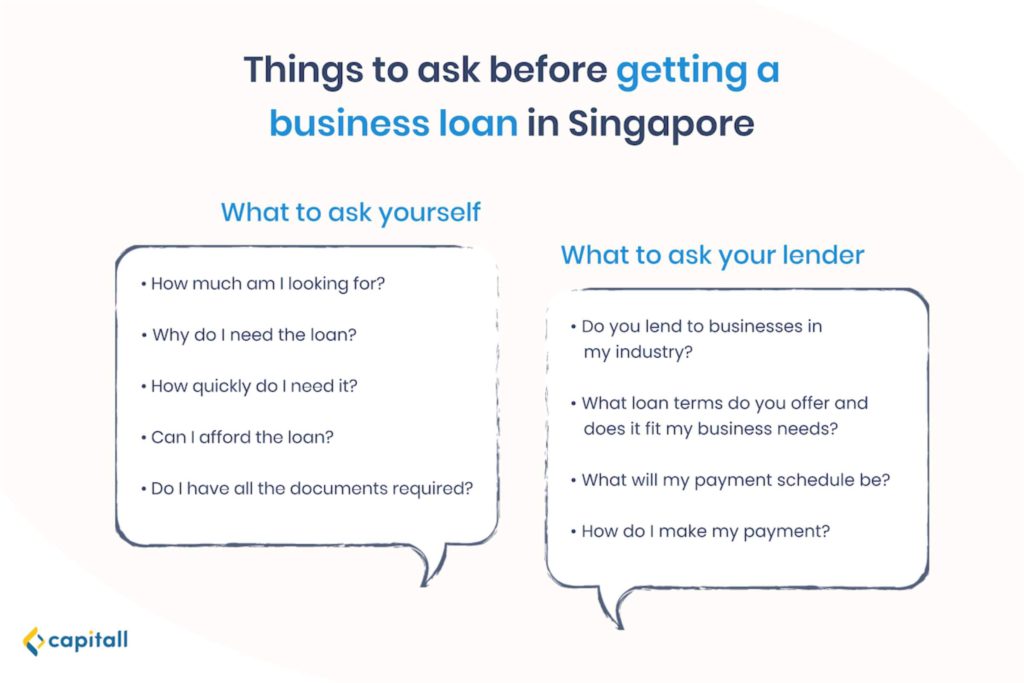

Here is a list of 9 questions you should ask yourself and your lender to help you narrow down the financial institution and the type of loan you should go for.

Let’s begin with what you need to ask yourself before going to any financial institution.

5 Questions You Should Ask Yourself Before Getting A Business Loan

1. What Do I Need The Business Loan For?

This may seem like a rhetorical question if you have already identified what you will be using the business loan for. However, being clear about the purpose of the extra capital will help in choosing the type of loan suited to your needs.

For instance, ask yourself if you need the loan to purchase capital-intensive items such as heavy machinery or vehicles for your company. Or will you be using the extra funds for an interim marketing campaign to promote a new product or service?

Knowing the objective of getting a business loan helps in identifying if a long-term or short-term loan fits your needs. Generally, a long-term loan comes with a lower periodic payment as compared to short-term loans. However, a long-term loan would incur higher total dollar costs due to the higher accumulated interest.

2. How Much Business Loan Do I Need?

One of the most obvious questions you will be asked when you approach any financial institution for a loan is the amount that you need for your business. It is therefore advisable that you do a careful calculation of how much you want to borrow.

Asking for an amount below what you need could affect your business’ working capital and lead to cash flow issues. Requesting higher than the needed amount might cause you unnecessary future expenses as you have to make repayments on the loan amount, including the business loan interest charged.

Some private financial institutions specifically cater to smaller loan amounts for businesses. Therefore, knowing how much you need would help in identifying the potential lenders to go to.

3. Can I Afford The Business Loan?

While your credit score is reviewed in a personal loan application, the approval process on a business loan requires both your personal credit score and your business credit profile.

You must prove that your business has a healthy cash flow. Lenders would scrutinise your company’s balance sheets, cash flow, bank, and income statements to ensure that you are able to make repayments on the requested business loan.

To instill confidence that your business can afford the loan, you must provide accurate information on your company’s finances.

You can also offer part of your company’s assets as collateral as this would indicate to the lender you are able to support the loan and are therefore worthy of receiving a higher amount.

4. How Quickly Do I Need The Business Loan?

Depending on the purpose of the extra capital, you need to ask yourself when you need the loan to be disbursed. If you need the funds within a couple of weeks, then you should find lenders that can approve your application within a short time. At Capitall, you can secure your business loans within 24 hours.

The processing time for a business loan in Singapore varies from one financial institution to another and can take up a day to a few weeks. Knowing how long the lender takes to get your loan approved would give you an estimate of when you can expect to get the needed extra capital.

5. Do I Have All The Documents Required To Apply For A Business Loan?

After ensuring the purpose, amount, timing, and affordability of the loan, the next thing you need to ask is whether you have all the required documents for the loan application.

Generally, most private financial institutions will require you to submit generic documents such as company bank statements, personal Credit Bureau Singapore (CBS) credit reports, and invoices.

Of course, you’ll have to check with your lender for the specific documents needed.

Private financial institutions such as Capitall, use MyInfo Business to onboard loan applicants, so the required documents that you’ll need to submit are generally reduced.

Now that you’ve thought through the questions, let’s talk about what you should pose to the financial institutions you intend to approach.

4 Questions You Should Ask Your Lender Before Getting A Business Loan

1. Do You Loan To Businesses In My Industry?

Not all financial institutions are created equal. Most of them specialise in providing loans in different sectors of the economy.

While loan amount is a factor when considering which lender to approach, the type of industry your business belongs to is another factor to take into account. Some financial institutions support certain industries and would therefore readily extend loans to companies within those industries.

Precious time would be saved if you know right from the beginning that the lender you approach supports your industry.

2. What Business Loan Terms Do You Offer And Do They Fit My Business Needs?

Assuming that you have identified the reason for the loan, you would know if you require a short or long term loan.

As a borrower, you must also be clear on issues such as the business loan interest rates imposed, the loan term available, and any additional administrative charges imposed by the lender.

3. What Will My Payment Schedule Be? When Will The First Payment Be Due?

The next question is to ask your lender for a payment schedule on the loan, as you must be prepared for the amount to be deducted on a regular basis.

You must also clarify when the first payment on the loan is due and allocate the appropriate amount before the time comes. As such, maintaining consistently steady cash flow in your business is crucial so as to avoid any late payments that might affect your loans in the future.

4. How Do I Make My Payment?

You should also ask the lender how you can make your loan repayments.

While cheques used to be a common mode of repayments, these days, business loan repayments are usually settled electronically.

This mode of payment is advisable as it ensures payments are made as scheduled. You can rest assured that the lender receives it as long as you have enough funds in your business account.

You must also take note of the breakdown in the amount to be periodically debited, taking into account interest rates and decreasing outstanding loan amount.

Here’s a table to summarise the key things to take note of regarding the loan:

| Loan terms | Interest ratesAdministrative feesLoan tenure |

| Payment | Payment schedule (e.g. when are the payments due?)Mode of payment: cheque or electronically |

If you intend to get a business loan in Singapore, there is a wide range of options made available by various banks and private financial institutions. Regardless of the purpose of the extra capital, the duration, and amount of the loan, you would be able to find a suitable lender that is willing to fulfill your business needs.

However, the multitude of loan options does not guarantee an easy or smooth approval process, particularly if you have a young start-up or a small business.

It is important that you know what questions to ask before talking to any lender. Be prepared and do your due diligence with the relevant documents before approaching a lender.