Business Line of Credit: How To Increase Your Chances Of Getting One

Every business will face trying times. The struggle of staying afloat amid reduced revenues or rising costs is an experience all businesses will go through at some point. The repercussions of the current COVID-19 pandemic is a testament to this. You need a healthy reserve of funds set aside for rainy days to see your business through hard times. An effective way to overcome such slumps is to have a business line of credit you can tap into.

Before you make an appointment with a lender, you need to learn how you can go about submitting a successful application for a business line of credit. After all, every application undergoes a thorough evaluation.

But what exactly is a business line of credit, and how does it differ from short-term loans and a business credit card? And more importantly, how do you raise your chances of securing one in the first place?

What Is A Business Line of Credit?

A business line of credit is a pre-approved sum of capital which you can draw from whenever you need to. You need not draw the full amount and you can opt to use it any time the need arises. Interest is charged on the amount that you draw from the pre-approved sum.

The key advantage of a business line of credit lies in its flexibility. Whether you are renovating your office, keeping your business afloat during lull periods, or hiring a team of freelancers, a business line of credit will come in handy. It is also a feasible option to cover recurring expenses like rental, employee salaries, and marketing campaigns.

Wish to know more about how a business line of credit can help your SME? Read about it here.

How Does A Business Line Of Credit Differ From Short-term Loans And Business Credit Cards?

Note that a business line of credit is not to be confused with short-term loans and business credit cards.

Short-term loans are lump sums that need to be repaid within a pre-specified time frame. This option is suitable for rare big-ticket purchases and less frequent expenditure.

A business credit card is a lot like a business line of credit. Both give you easy access to a line of credit. The main difference is the limits—business credit card limits are much lower, and this option is typically used for day-to-day expenses of a business.

Here is a quick breakdown of the key characteristics of these 3 business loans available in Singapore.

| Type of Loan | Business Line of Credit | Short-term Loan | Business Credit Card |

| Loan Mechanics | – Revolving line of credit – Draw from credit line when needed, with interest charged on these amounts – Credit limit returns to the original when repayment is made | A lump sum of money to be repaid over a fixed time frame | – Revolving line of credit – Lower credit limit than business line of credit |

| Best Suited For | Operational expenses and gaps in cash flow | Expenses that are larger and less frequent | Day-to-day expenses like office supplies, travel, meals, software upgrades, etc. |

Now that you have reviewed your options and you have set your mind on getting a business line of credit, here comes the tricky part—the application. How do you raise your chances for a successful application? What do lenders look at when it comes to approving an application?

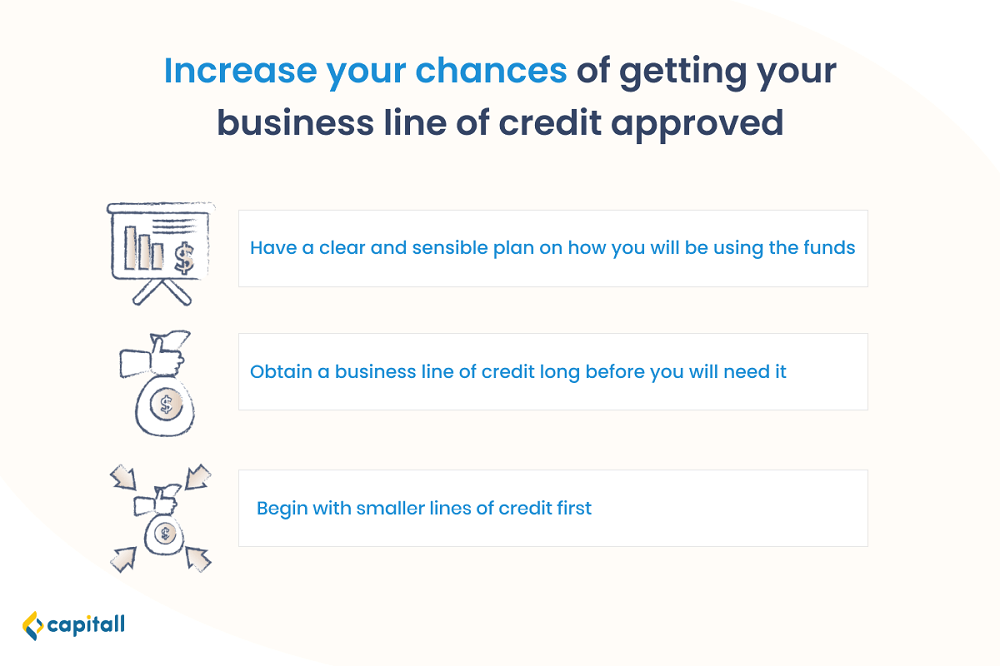

How To Raise Your Chances Of Securing A Business Line Of Credit

The most common criteria that lenders look at is credit score. This is a quick way for lenders to determine if you will be a reliable borrower and that they will not face difficulty collecting payments from you.

However, when it comes to assessing your application, private financial institutions do not scrutinise your credit history as much as banks.

The only way to get a good credit score is to establish a good and extensive credit history. However, if you are running a new business or you have had trouble with loan repayments in the past, establishing a good credit score isn’t going to be easy.

But credit score aside, what can you do to improve your chances of getting your application for a business line of credit approved?

1. Provide A Clear And Sound Plan Of How The Business Line Of Credit Will Be Used

Your lender needs to know that the funds will be put to good use and that you are capable of repaying it.

Create a list of projected expenditures that will be funded by the credit line. Providing a detailed plan demonstrates your financial responsibility and readiness with how you intend to use the funds.

If possible, explain how the expenses can improve your business. This will show that you know how to handle funds sensibly and that you will be able to repay your debts on time. Here are some important details you should include in your plan:

- Contingency repayment plans for worst-case scenarios (drop in sales, supplier bankruptcy, natural disasters, etc.)

- A comprehensive list of existing projects and projected completion timelines

- An overview of upcoming projects or campaigns

- Recent business successes

Even if you are not applying for a line of credit, you should still consider creating a plan like this. Developing an overview of your expenses will also benefit you by providing more clarity on how your business should move forward.

2. Apply For A Business Line of Credit Before You Need It

Imagine yourself as a lender and you have 2 different applicants.

You have Mr. A, who has run out of funds and is in desperate need of a bail out. You also have Mr. B, who has got a good amount of savings and is just looking to safeguard against rainy days. In such a scenario, Mr. A seems more likely to default on his payments due to his financial situation.

The best time to apply for a business line of credit is when you do not need it at all. Apply when your business has good cash flow and you have been reaping healthy profits.

Lenders feel safer approving applications of businesses that have enough cash to cover payments in the foreseeable future. Additionally, with a higher sense of security, lenders will be more willing to grant favourable lending terms.

To take up a business line of credit even before you need one, you will need to first provide a reasonable forecast of your business needs. Come up with revenue projections and make assessments on what your capital needs will be far into the future. Identify potential challenges and periods of high costs in the next 6 months to a year.

So get your applications in early! Treat this as an opportunity to start building your credit history to earn a good credit score—at a time when you will be more capable of fulfilling your credit obligations.

3. Start With A Smaller Business Line Of Credit

At the end of the day, you might only be able to secure a business line of credit that has a low limit. Take this as a sign that your business might not be ready to take up such large amounts of credit.

Lenders assess the financial health of businesses regularly. As such, they are probably right to declare that your business is not ready to commit to having access to a huge sum.

By working with a smaller limit, it would be easier to make payments on time. Also, even if you are able to secure a larger sum, always work with credit lines that your business can handle. Do not bite off more than you can chew or you could end up with bad debt and poor credit scores.

Take progressive steps and focus your efforts to growing your business. As your credit history and company’s financial position improves, you will soon be eligible for higher credit limits and better lending terms.