5 Tips On Using A Merchant Cash Advance And How To Relieve Debt From It

It can be tough owning a business, especially in Singapore, the world’s most competitive economy. There might come a time when a short-term expense puts you in need of additional financing. Perhaps you’re looking for a merchant cash advance because you need cash urgently. Or maybe you have a credit history that didn’t fit the terms and conditions of a business loan.

Whatever your reason may be for seeking out a merchant cash advance in Singapore, it’s important to take time to do your research.

Unfamiliar with the term and want to find out more about merchant cash advance? Here’s a guide.

Before getting a merchant cash advance, here are some tips that you should take note to help you make an informed decision.

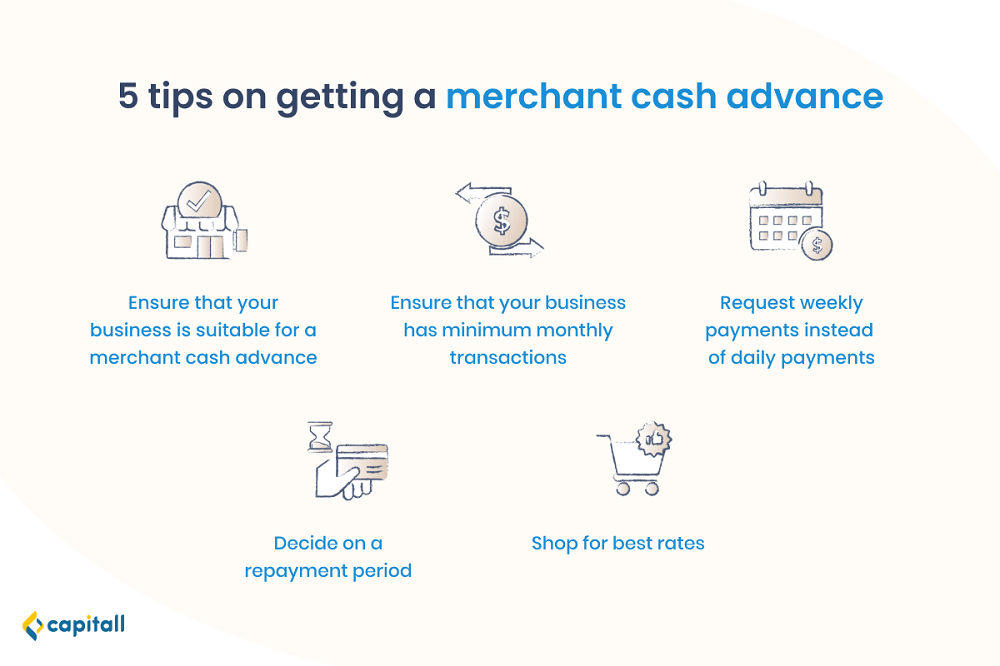

5 Tips On Getting A Merchant Cash Advance

Planning to get a merchant cash advance rather than a business loan? Remember to keep these tips in mind.

1. Ensure That Your Business Is Right For Merchant Cash Advance

A merchant cash advance can sound like a good idea; however, it may not be the best financing solution for all businesses.

Firstly, you need to consider whether your industry is well-suited for it. Suitable candidates are typically small to medium-sized businesses that receive the majority of their payments through credit card sales. Businesses such as restaurants, cafes, and shops are among industries that benefit most from merchant cash advances.

As a merchant cash advance is practically a purchase of your business’s future revenue, you need to have a large amount of transaction and incoming credit card sales to qualify. If your business does not support credit card payment processing, it would be wiser for you to consider an alternative financing product such as a business loan.

Not sure if a merchant cash advance fits your business? Learn more about it here.

2. Ensure That Your Business Has A Steady Stream Of Transactions

To get a better overall idea of your business’s financial standing, you will need to show that your business has a constant stream of monthly sales.

Different lenders have different conditions, but as a rule of thumb, lenders generally require your business to have a steady stream of credit card transactions over the last 6 months.

If you do not fulfil this requirement, you can try applying for a merchant cash advance again at a later date.

3. Request Weekly Payments Instead Of Daily

Although payment is typically made daily, certain lenders will allow weekly payments.

Rather than remitting money directly from your business account daily, the lender can set it up to remit once a week. That way, you can set aside funds for the week and avoid the burden of daily cash-flow strains.

4. Decide On a Repayment Period

Whether it is a business loan or a merchant cash advance, it is always good to consider how you will utilise the cash beforehand. This would allow you to plan for the repayment period, which typically ranges from 3 months to 12 months.

If the advance is meant to cover a one-off expense like new equipment, you can pick a shorter repayment time frame. If it is used to start an expansion project which spans over a period, then you might want to choose a longer repayment period.

Setting up a repayment period that is suitable for your business is important, as the repayment is directly debited from your sales. The last thing you want is to bite off more than you can chew.

5. Shop For The Best Rates

The paradox of choice is something that we face with decision-making today. There are so many lenders in Singapore that finance small businesses; however, they vary in their terms, fees, as well as rates they charge.

Do your research to shop for the right lender that is reliable and can give you a reasonable rate.

If you were to take up any merchant cash advance product that comes your way, you could potentially miss out on other competitive options.

Why You Should Not Rush Into Getting A Merchant Cash Advance

There are many ways a business can end up in a debilitating debt, and one of the ways is to rush into getting a loan or advance.

Although merchant cash advance provides you with immediate cash, it can also be rather expensive to manage. A typical merchant cash advance takes a chunk out of your revenue daily, which can adversely affect cash flow. That is why you should always negotiate the terms of your advance and apply the tips previously shared.

The high and frequent payments that you have to deal with when taking a merchant cash advance may also not be worth the trade-off. Since it doesn’t accrue higher interests over time, there would not be any benefit to paying off a merchant cash advance more quickly.

In addition to the repayment terms, lenders will also charge a fee based on factoring. The factor rate is decided based on a risk assessment. A higher factor rate would mean that your business is deemed as a high risk, and thus, a higher fee to pay.

While a merchant cash advance could get you immediate funds, having to pay it off daily can land you in deeper cash flow troubles. Therefore, do not rush into getting a merchant cash advance. Take time to consider its pros and cons, plan ahead, and ensure that your business has the ability to take up the advance and make the repayments.

How To Relieve Merchant Cash Advance Debt

If you find yourself in merchant cash advance debt, here are some things you can do to take back control of your business and get out of debt.

1. Renegotiate The Merchant Cash Advance

If you are struggling or worried about your cash flow due to the merchant cash advance, you should try to renegotiate your terms with the lender.

It is important to prove to the lender that you can repay the debt with the new terms. If your business has seen an increase in credit card sales, be sure to use it as evidence for negotiation.

2. Replace Merchant Cash Advance With A Business Loan

Replacing your merchant cash advance debt with a business loan is one way to pay off your debt.

Business loans carry more favourable terms, and more importantly, they have lower interest rates, longer repayment periods, and more flexible repayment structure. This makes it a good option for business debt consolidation.

You can take up a business loan with a bank or a private financial institution if your business meets the following criteria:

| Criteria | Banks | Private financial institutions, e.g. Capitall |

| Business operation | Minimum 2 – 3 years | At least 10 months |

| Annual revenue | At least S$300,000 | At least S$100,000 |

| Loan approval | Between 2 – 3 weeks; complicated cases could take up to 1 month | Within a week or even on the same day |

Read more about the types of business loan options here.

3. Get An Asset-backed Loan

An asset-backed loan is guaranteed by your business collateral.This means that if you default on an asset-backed loan, the lender will seize your assets (e.g. property, inventory) to repay the debt.

Compared to an unsecured business loan, an asset-backed loan is easier to get approval as it is deemed less risky for lenders. It also typically offers lower interest rates and longer repayment terms than merchant cash advances, which you can use to refinance your debt.

Another benefit of the asset-backed loan is that your ability to pay is reflected in your credit history. This means that if you find an asset-backed loan that is suitable for your business, not only can you pay off your debt more favourably but also increase your credit score if you repay your bills on time.

4. Consolidate Your Merchant Cash Advances

If you have debt from numerous merchant cash advances, you might want to consolidate your debt into a single loan to repay all your existing debts.

One of the significant benefits is that it can lower your overall repayment interest and make managing your loan easier since you only have to keep track of one single loan. To ensure that you are consolidating properly, look for financial institutions who have experience in managing merchant cash advance debt.