Business Loan In Singapore: How Can Invoice Financing Help Your Business?

Being cash-strapped is not a great feeling. Running a business and managing operational expenses and monthly overheads can get stressful. Thus, having a good cash flow is essential to ensure that your business stays afloat and prospers. But how do you ensure a good cash flow when your business relies heavily on invoice payments? Outstanding invoices and delayed payments can leave you in a rut. Well, one quick fix businesses and SMEs can consider is a type of business loan called invoice financing.

What Is Invoice Financing?

Invoice financing is a short term business loan used by SMEs and businesses based on outstanding invoices by selling this to factoring companies. Through this, it can alleviate cash flow problems.

In short, there are 2 types of invoice financing available: invoice factoring and invoice discounting. For this article, we’ll be focusing on invoice factoring, also commonly known as invoice financing.

Invoice factoring is the more common practice out of the two. With this loan, businesses will have speedy cash flow even if payments for outstanding invoices are a month or more away. The cash flow can be used for current operational expenses or to invest and expand the business.

This type of loan has lower interest rates and is more flexible as businesses can decide the duration of funding. The average period of funding is a short period of 15 days to a year. Thus, invoice financing is a quick fix solution for capital injection for businesses for a short period of time.

Here’s a quick overview of the differences between invoice factoring and invoice discounting.

| Invoice Factoring | Invoice Discounting |

| Invoices are used as collateral and are sold to the lender | – |

| Able to receive cash speedily | – |

| Lower interest rates | – |

| 70% – 90% funding of the total invoice | Larger funding percentage of the total invoice |

| Factoring company will collect payment directly from clients | SMEs and businesses manage the collection of payment |

| Remaining 10% – 30% of invoice minus factoring fee will be paid to SMEs and businesses once payment is collected | SMEs and businesses have to pay loan and factoring charges once payment is collected |

| Used by start-ups or SMEs | Used by larger, established companies |

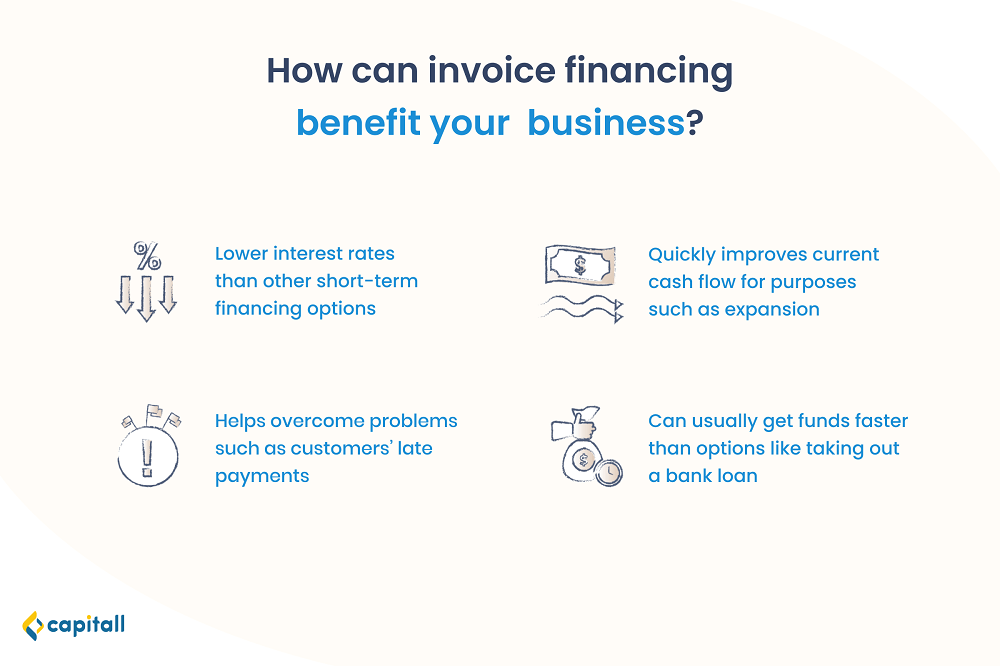

How Does Invoice Financing Benefit Your Business?

1. Short-term option with low-interest rates

As goods and services have already been delivered, and the only step left is for the invoice to be paid; in comparison to other types of short-term loans, invoice financing is deemed less risky by financial institutions.

2. Improve Business Cash Flow

Poor cash flow is one of the main reasons a small business fails. Outstanding invoices can lead to poor cash flow due to pending or delayed payments.

Therefore, improving cash flow through business loans like invoice financing can help to reduce the risk of your business failing, and gives you the option to use the resources for other things.

With cash flow not being an issue, businesses can explore opportunities and get ahead of their competitors.

3. Overcome Delayed Payments

If your business relies on invoices to pay the bills, profit and finances may be affected due to outstanding invoices.

SMEs are vulnerable to disruption, and cash flow issues can aggravate that. Your business may also lose investing and expanding opportunities if you take up precious time and resources to chase after late payments.

When you opt for invoice financing, the factoring company will assist in collecting the payments; thus ensuring that overdue payments do not hinder you from settling other operational expenses, or expanding and investing in business opportunities. You will be able to refocus your time and resources on improving and growing your business operations.

4. Secure Quicker Funding

If you are applying for a business loan with a bank, the wait time could range from 2 weeks to 3 weeks before receiving approval and funding. Unfortunately, your business cash flow and operations may be affected while you wait.

With invoice financing, approval is quick, and businesses receive funding faster as compared to getting a normal business loan. Without the long waiting time, businesses can operate without disruption to the operations and can even use the excess cash flow for other opportunities.

Benefits And Drawbacks Of Invoice Financing in Singapore

Benefits

1. Quick Access To Cash

You can get fast access to working capital using invoice financing.

With quicker access to cash, businesses with tight cash flow can now utilise invoice financing to improve their cash flow as and when they have to.

This can allow businesses to take on new projects, experiment with new ideas, and cover expenses without being tied up due to outstanding invoices and poor cash flow.

2. Management Of Account Receivables

When you opt for invoice financing in Singapore, your invoices are passed to the factoring company to manage. This can ease the burden on you, as you do not need to chase or stress over payments.

The factoring company will help to look after your account receivables, manage the credit control processes, and manage delayed and ongoing payments. They can also sometimes help to negotiate better terms with suppliers or clients.

3. Only Invoices As Collateral

In most cases, the only security needed to set up the invoice financing in Singapore are the invoices. Your invoices will act as your collateral. As such, you will not have to use an asset such as your business property or vehicle for collateral backing.

4. Does Not Impact Your Business Credit Score

As invoice financing is a sales transaction that exchanges cash for an outstanding invoice, it does not impact your business credit as it is not considered a debt. So, there is no need to worry about your business credit history being affected when obtaining an invoice financing in Singapore.

Drawbacks

1. Unable To Obtain Full Funding For Full Value Of Invoices

Invoice financing does not give you the freedom to choose the amount you would like to borrow as it is relative to the total invoice amount.

Depending on the type of invoice financing, businesses are only able to receive 70% – 90% of the invoice amount. Thus, you will not be able to receive the full funding value of your invoices.

2. Risk Of Being Over-reliant On Invoice Financing

While invoice financing can ease the financial burdens of outstanding invoices, it can be a vicious debt cycle if the business has any underlying cash flow issues.

SMEs and businesses can be over-reliant on invoice financing and may not address the real problem affecting the business. This can cause the business to be in a vicious cycle of having to apply for invoice financing repeatedly to manage their monthly cash flow problems. This can be a problem in the long run as the business is not healthy and can result in failure of the business.

3. The Factoring Company May Be Seen As A “Debt Collector”

Some clients prefer to deal with your business directly instead of the factoring company. They may perceive them as a “debt collector”, and that can impact the impression the clients has on your business.

Your clients may also assume the cash flow problems that your company is facing. This can affect your relationship with them and may even cause the business to lose them.

Don’t let outstanding invoices stand in the way of the success of your business. In Singapore, invoice financing is an easy solution to handle your finances while you can focus on managing your business operations.

Looking for business loans in Singapore? Reach out to Capitall and speak to our friendly financial consultants today.