What Is The Cost Of Owning A Car In Singapore?

A car is possibly the biggest purchase you might make aside from buying a house. We always hear or know that owning a car, especially in Singapore, is expensive. But do you know the actual cost of owning a car in Singapore?

First, what makes a car so expensive to own in Singapore?

Singapore has a total land area of 721.5km2. Given the land scarcity, building more roads is not sustainable. Roads only occupy 12% of Singapore’s land area, as compared to 14% for housing.

Hence, the government has several measures in place to manage the level of vehicle population, making buying and maintaining a vehicle in Singapore an expensive luxury.

Full Breakdown: The Cost Of Owning A Car In Singapore

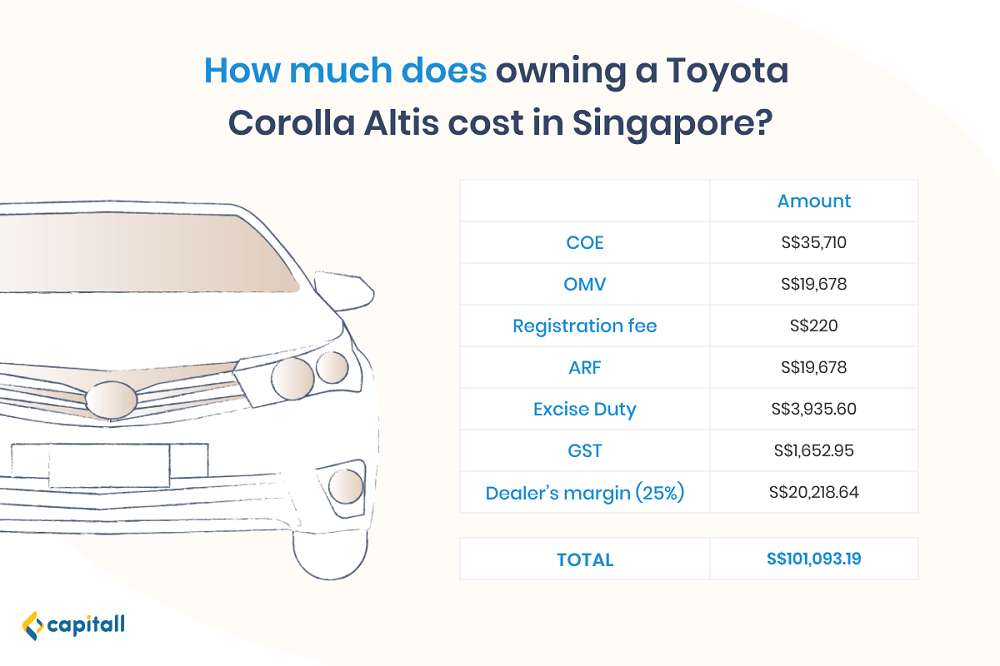

To illustrate, we’ll use the Toyota Corolla Altis 1.6 Standard to show the breakdown of the cost of owning a car in Singapore:

In fact, the high cost of owning a car in Singapore has made it the world’s priciest city.

Here, we take a closer look at the costs involved in owning a car in the country.

1. Certificate Of Entitlement (COE)

This term is something most Singaporeans would have heard of. A Certificate of Entitlement (COE) gives you the right to register, own, and use a vehicle in Singapore. Before you purchase a car, you will need to get a COE first.

The COE is used to control Singapore’s car population. It lasts for 10 years and is one of the biggest reasons why owning a car in Singapore costs so much.

COE prices fluctuate based on market demand. Hence, the higher the number of people bidding for it, the higher the COE prices will be.

There are 2 bidding exercises by LTA every month, held on the first and third Monday of every month. Due to COVID-19, the bidding exercises were put on hold. However, it has since resumed as of Monday, 6 July 2020.

There are 5 categories of COE:

| COE Vehicle Categories | Prices as of March 2020 | |

| Category A | Car 1,600cc and below with engine power not more than 97kW | S$35,710 |

| Category B | Car above 1,600cc or with engine power not more than 97kW | S$38,802 |

| Category C | Goods vehicles and buses | S$25,006 |

| Category D | Motorcycles | S$7,432 |

| Category E | Open (any other kind of vehicles) – except motorcycles | S$38,110 |

Source: LTA

At an engine capacity of 1,598 cc, the Toyota Corolla Altis has a COE of S$35,710.

2. Open Market Value (OMV)

The Open Market Value (OMV) is determined by the Singapore Customs. It is based on the actual price paid for the vehicle when it is imported to Singapore.

The OMV price includes:

- Purchase price

- Freight cost

- Insurance

- Incidental charges related to the sale and delivery of the car

- Other charges incurred during sale and delivery of car to Singapore

In short, it is the cost of a car before taxes, entitlement, and top-ups.

As of June 2020, the Toyota Corolla Altis has an OMV of S$19,678.

3. Registration Fee

A Registration Fee of S$220 will also be charged upon registration of a new car.

4. Additional Registration Fee (ARF)

The Additional Registration Fee (ARF) is a form of tax imposed upon registering for a new car.

ARF is calculated based on the OMV of the car:

| OMV of Vehicle | Additional Registration Fee (ARF) Rate |

| First S$20,000 | 100% of OMV |

| Next S$20,001 to S$50,000 | 140% of Incremental OMV |

| Above S$50,000 | 180% of Incremental OMV |

Source: LTA

Vehicular Emissions Scheme (VES) rebates (if any) will be subtracted from the above-listed values.

The ARF is a significant expense. However, you can recoup the cost if you deregister your car through scrapping or exporting before it turns 10 years old through the Preferential Additional Registration Fee (PARF). This scheme is to ensure a young and roadworthy fleet for smooth flowing traffic.

As the OMV of the Toyota Corolla Altis is within S$20,000, the ARF to be paid will be S$19,678.

5. Excise Duty

Excise duty is another form of tax on registering a car.

A car falls under 1 of the 4 categories that are liable for excise duty — alcohol, cigarettes, motor vehicles, and petrol and biodiesel.

The excise duty of a car is 20% of its OMV.

This means that the excise duty to be paid for the Toyota Corolla Altis will be:

0.2 x S$19,678 = S$3,935.60.

6. Vehicular Emissions Scheme (VES)

To reduce carbon emissions and pollutants, the Vehicular Emissions Scheme (VES) is introduced to incentivise buyers to choose vehicles that are more environmentally friendly.

This is done by giving rebates. The scheme was proven to be effective and will be extended till 31st December 2020.

Since 1 January 2018, all new cars, taxis, and newly imported cars registered are assessed based on their emissions of pollutants:

- Carbon dioxide

- Hydrocarbons

- Carbon monoxide

- Nitrogen oxides

- Particulate matter

You will enjoy a rebate or pay a surcharge, depending on the band your vehicle falls under.

If your vehicle is registered between 1 January 2018 and 31 December 2020, here are the rebates or surcharges that your vehicle will be subjected to.

| Band | Carbon dioxide (g/km) | Hydrocarbon (g/km) | Carbon monoxide (g/km) | Nitrogen oxide (g/km) | Particulate matter* (mg/km) | Rebate** | Surcharge |

| A1 | A1≤90 | A1≤0.020 | A1≤0.150 | A1≤0.007 | A1= 0.0 | S$20,000 | – |

| A2 | 90<A2≤125 | 0.020<A2≤0.036 | 0.150<A2≤0.190 | 0.007<A2≤0.013 | 0.0<A2≤0.3 | S$10,000 | – |

| B | 125< B≤160 | 0.036<B≤0.052 | 0.190<B≤0.270 | 0.013<B≤0.024 | 0.3<B≤0.5 | – | – |

| C1 | 160< C1≤185 | 0.052<C1≤0.075 | 0.270<C1≤0.350 | 0.024<C1≤0.030 | 0.5<C1≤2.0 | – | S$10,000 |

| C2 | C2>185 | C2>0.075 | C2>0.350 | C2>0.030 | C2>2.0 | – | S$20,000 |

*Not applicable to vehicles registered from 1 January 2018 to 30 June 2018.

**Subject to a minimum payment of S$5,000 for ARF

Source: LTA

If you register a car under bands A1 and A2, you will qualify for the rebate. However, no matter the difference, you will still have to pay a minimum ARF of S$5,000.

If your car falls under bands C1 and C2, you will have to pay an emission surcharge on top of your ARF.

Other Charges

On top of paying the charges mentioned earlier when you first buy the car, you will have to pay other charges like road tax.

1. Road Tax

The bigger the engine of your car, the higher the road tax you will have to pay for. All vehicle owners need to have a valid road tax for their vehicles before they can be used on the roads.

Most road taxes are renewable on a 6-month or yearly basis.

The road tax is calculated as follows:

| Engine Capacity (EC) in cc | 6-Monthly Road Tax |

| EC ≤ 600 | S$200 x 0.782 |

| 600 < EC ≤ 1,000 | [S$200 + S$0.125(EC – 600)] x 0.782 |

| 1,000 < EC ≤ 1,600 | [S$250 + S$0.375(EC – 1,000)] x 0.782 |

| 1,600 < EC ≤ 3,000 | [S$475 + S$0.75(EC – 1,600)] x 0.782 |

| EC > 3,000 | [S$1,525 + S$1(EC – 3000)] x 0.782 |

Source: LTA

Given that Toyota Corolla Altis car has an engine capacity of 1,598 cc, the annual road tax will be:

{[S$250 + S$0.375(1,598 – 1,000)] x 0.782 } x 2 = S$742

2. Vehicle Registration Number (VRN)

Typically, you do not have to pay any charges if you choose the Vehicle Registration Number (VRN) that is automatically assigned to you by LTA.

However, if you would like a specific VRN, you will first have to go through a bidding process. Be prepared to spend a lump sum if you are going for a nice, lucky number.

3. Goods And Services Tax (GST)

Cars are also subjected to GST and are taxed on both the OMV and Excise Duty.

At 7% GST, the total GST to be paid for the Toyota Corolla Altis will be:

0.07 x (S$19,678 + S$3,935.60) = S$1,652.95

4. Dealer’s Commission

Dealers usually charge an additional fee to cover their costs and make a profit. The commission can be from 15% of the basic cost for affordable car brands and up to 50% for the luxurious ones.

Let’s say the dealer’s commission is 25%. This means that the commission for the Toyota Corolla Altis will be:

0.25 x (S$19,678 + S$19,678 + S$3,935.60 + S$1,652.95 + S$35,710 + S$220) = S$20,218.64.

5. Insurance

It is a must to have insurance for all vehicles in Singapore.

If you are found driving a motor vehicle in Singapore without insurance coverage, you will be guilty of an offence. Under the Singapore Motor Vehicles Act, you can be fined up to S$1,000, or charged with imprisonment for up to 3 months, or both.

Insurance rates vary based on factors such as your age and experience, as well as your claims history.

The cost of insurance for a Toyota Corolla Altis is estimated to be S$1,574.

6. Parking

This is another ongoing cost you cannot avoid when you own a car in Singapore.

For instance, HDB season parking costs between S$90 and S$120 a month. You will also have to factor in other parking costs when you head out.

7. Electronic Road Pricing (ERP)

Electronic Road Pricing (ERP) is charged when you travel through the city centre during peak hours. The rates depend on the location and time you’re driving through the city centre.

8. Petrol

Another ongoing cost that you will have to bear is petrol costs. The cost depends on your car usage and the type of petrol you use.

Let’s say your car travels 17,500km annually. A standard 95-octane petrol costs S$2.25 per litre.

Using Toyota Corolla Altis as an example, it can travel for 15.4km per litre of fuel. This gives an annual petrol cost of:

(17,500km ÷ 15.4 km per litre) x S$2.25 = S$2,557

- Maintenance And Servicing

You will also need to consider the costs of maintenance and servicing of the car. It is advised to get your car serviced every 6 months or 10,000km. The maintenance and repairs may also cost more if you happen to run into accidents.

The annual maintenance of Toyota Corolla Altis is estimated to be S$528.

How Much Will Everything Cost in Total?

After adding all the components together, here’s the total cost of owning a Toyota Corolla Altis 1.6 Standard in Singapore:

| Components of a Toyota Corolla Altis purchase price | Amount |

| COE | S$35,710 |

| OMV | S$19,678 |

| Registration fee | S$220 |

| ARF | 100% of the first S$20,000 of the OMV: S$19,678 |

| Excise Duty | 20% of OMV: S$3,935.60 |

| GST | 7% of OMV and Excise Duty: S$1,652.95 |

| Dealer’s margin (25%) | 25% of OMV, ARF, Excise Duty, GST, COE, registration fee: S$20,218.64 |

| Total | S$101,093.19 |

Source: LTA, MoneySmart, and Dollars and Sense

Not to forget, other recurring and mandatory fees that you will have to bear:

| Estimated Annual Car Running Cost | Price |

| Road Tax | S$742 |

| Fuel Cost | S$2,557 |

| Maintenance | S$528 |

| Insurance | S$1,574 |

| Total | S$5,246 |

Source: Budget Direct

This is excluding ERP and parking fees as that differs from person to person.

Now that we have got this straightened out, you might be thinking: How can I afford a car if I have not saved up for one?

Not to worry, you can apply for a car loan to fund your car purchase. With auto financing, you can still buy a car in Singapore.

What Is Auto Financing?

Auto financing is a type of loan for vehicle purchase. A lot of people in Singapore take out an auto financing loan, especially since the cost of owning a car in Singapore is so high.

It is provided by banks and private financial institutions to help you fund your vehicle purchase.

As it is a type of secured loan, the vehicle that you will be purchasing will be the collateral. Terms of the auto financing loan will be set by your lender. Some of them include fees, stipulation, penalties, monthly instalment payments, and late payment fees.

Learn more about auto financing loans in Singapore here.

Given the high cost of owning a car in Singapore, an auto financing in-house loan can help fund your car purchase, freeing up cash for more urgent payments.