Why Your Business Loan In Singapore Might Have Been Rejected

There’s nothing more frustrating than to find out that your business loan application has been rejected.

Business owners look to banks and financial institutions to get business loans for a myriad of reasons. Whether it is to expand, innovate, or to cover day to day operations, having access to funds at the right time is crucial.

It never feels good to be notified about your application’s rejection. After all, you went through the trouble of going through all the paperwork and sending in the necessary documents. These processes take time away from you and your business.

So why did your application get rejected? If you’ve already given in all the required documents, why did it go wrong?

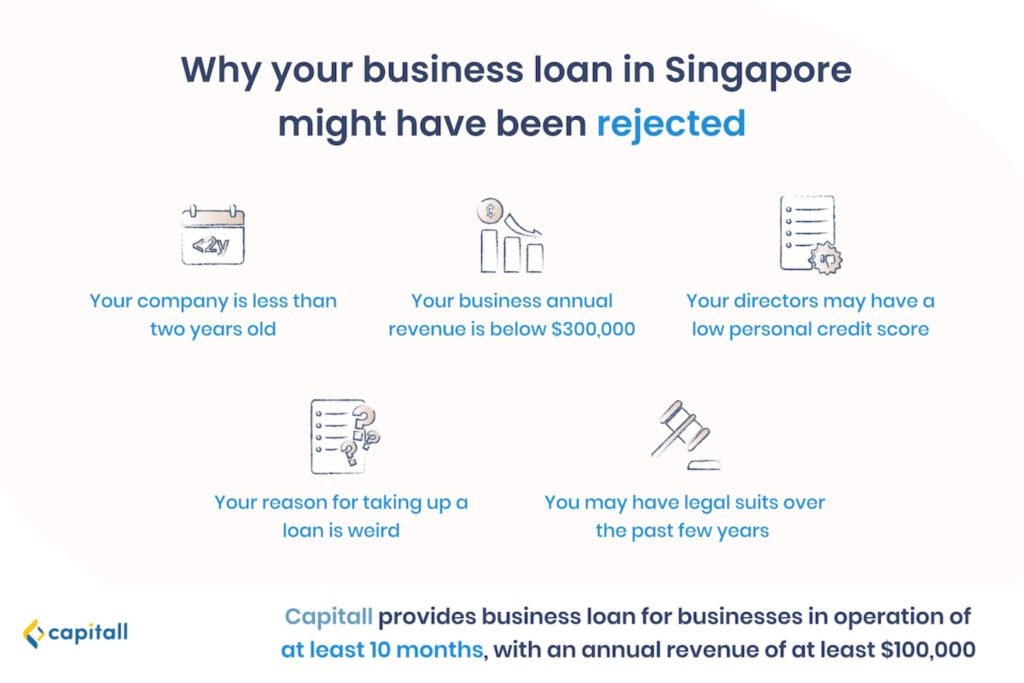

Here are 5 possible reasons why your application didn’t go through.

1. Your Company Is Less Than 2 Years Old

How long your company has been around makes a difference when it comes to getting loans.

Banks and private financial institutions want to know their funds are being lent to a trustworthy company and not just any business in the market.

After all, all lenders must be responsible for the risks they take.

In general, banks and financial institutions only approve loan applications to businesses that have been around for at least 2 years.

This is because SMEs which are younger than 2 years are more volatile and unstable. As such, lending out funds to these young companies means taking higher risks for banks.

If your loan application didn’t get through, it could be because your business is still too new. With little to no track records, it’s hard for banks to access how much risk they are taking when they lend you funds.

That being said, this doesn’t mean it’s impossible for you to get hold of funds. If your business needs a business loan but is younger than 2 years, perhaps it would make more sense to get a loan with private financial institutions.

2. Your Business Annual Revenue Is Below S$300,000

With most banks and financial institutions, businesses need to have an annual revenue of at least S$300,000 to be eligible for getting loans.

A business’ annual revenue is a marker of how well a business is doing and whether it is stable enough to repay debt. However, these requirements make it difficult for many SMEs to borrow funds with banks.

If your business is still relatively new and has yet to make such a large annual revenue, you should consider borrowing funds with private financial institutions.

3. Your Directors May Have A Low Personal Credit Score

Personal credit scores matter when you are taking a business loan. Lenders often check personal credit scores of CEOs and key personnel of every business before approving loan applications.

Businesses are, after all, run by people. And lenders want to know that their funds will be stewarded well, by individuals who have a good track record.

It can be frustrating to learn that your business loan can’t get through just because one of your directors has a bad personal credit history.

If you or any of your business’ directors have a low credit score, you will need to work on improving your credit score first.

4. Your Reason For Taking Out A Loan Is Weird

Yes, your reason for taking a loan matters.

Lenders want to know what their funds are being used for. The last thing they want is to find out they are supporting questionable activities.

If you have provided a reason that strays from the ordinary for getting a loan, lenders will likely turn down your application.

Generally, lenders are more inclined to support loans that are used for company growth and working capital. They want to know that their funds are being put to good use and be assured that you will steward the funds well.

Giving your lenders a sense of assurance is vital if you want your application to go through.

5. You May Have Legal Suits Over The Past Few Years

Legal suits will definitely impact your credit assessments because legal processes more often than not weigh down on your business financially.

Lenders are generally unwilling to lend funds to businesses that have been involved in legal suits because it could suggest that they may face challenges in paying back loans.

Do any of the points above sound like your business? If so, does it mean it’s impossible for you to get a business loan?

Well, the good news is, you can still secure a business loan if you take some active steps to improve confidence from lenders.

How To Improve Confidence From Lenders

| Ways to improve confidence from lenders | What it can mean |

| Build your business credit | You are timely with your paymentsYou have a healthy relationship with your vendorsYou can be responsible with your loans |

| Have running projects | Your business is doing wellYou have the capability to earn enough to repay any loan |

| Maintain consistency with finances | You are consistent and have good financial habitsYou can be trusted to pay monthly instalments and repay your debts |

Build Your Business Credit

Having a good credit history is vital if you want to get your loans approved. To get good business credits, you will need to stay on top of all your payments and maintain healthy relationships with vendors. Make sure you put in the effort to be timely on all your payments and actively improve it.

The key to building a strong business credit is to be consistent. Being timely with your payment once isn’t enough. You need to show that your business has a track record of being responsible with loans. Therefore, showing that you are consistent in keeping up with these efforts will pay off in the long run.

Have Running Projects

Having projects on your plate signals to lenders that your business is doing well. This is going to sound harsh but it’s true — no lender will be keen on lending funds to businesses that don’t have any form of continuous income.

Having running projects is crucial because it shows that your business has the capability to earn enough to repay any loans it incurs. In order to have your loan application approved, you will need to first allow lenders to trust in your business.

Maintain Consistency With Finances

The key to getting your loans approved is to show that you are consistent with your finances. Paying monthly instalments on time, repaying your debts, and working on projects — these cannot simply just be a one-time effort.

Having a good credit score requires consistency. The same goes to building trust with lenders. You need to show that you are consistent in keeping up with good financial habits.

If your business loan got rejected because of poor credit scores or legal suits, you will need to put in even more effort to show consistency in your business’ track record. Trust and assurance are the keys for loan applications to be approved.

There are many reasons why your business loan application couldn’t get through. Sometimes, it’s because your business is simply too young or earning too little revenue. If that’s the case, you’ll need to wait for your business to mature and stabilise before applying for a loan again.

However, if your loan application got rejected due to bad credit scores, you’ll need to put in the effort to improve it.

Having a poor credit score can prove to be problematic for your business in the long run because it signals to lenders and banks that they are taking high risk in lending funds to you.