What Are Your Options If Your Temporary Bridging Loan Programme (TBLP) Application Is Rejected?

The pandemic has severely impacted Singapore’s economy and affected many companies, especially Small and Medium Enterprises (SMEs). To support local firms, the government has rolled out several schemes for businesses. If you are reading this article, chances are that you applied for the Temporary Bridging Loan Programme (TBLP).

In this article, we provide several options that you can explore if your application was rejected.

How Does The Temporary Bridging Loan Programme (TBLP) Work?

The TBLP is a scheme that provides firms from all sectors access to working capital for business needs.

Eligible firms may borrow up to S$5 million from participating financial institutions for applications until 31 March 2021. For applications from 1 April 2021 to 30 September 2021, eligible firms may borrow up to S$3 million.

The interest rate is capped at 5% p.a., and the maximum repayment period is 5 years.

The loan programme is managed by Enterprise Singapore (ESG), with the government providing 90% risk-share on loans initiated from 8 April 2020 to 30 March 2021, and 70% risk-share for applications from 1 April 2021 to 30 September 2021.

As attractive as all this sounds, approval of your temporary bridging loan application is still dependent on the assessment of the financial institution you are borrowing from.

So what should you do if your application has been rejected?

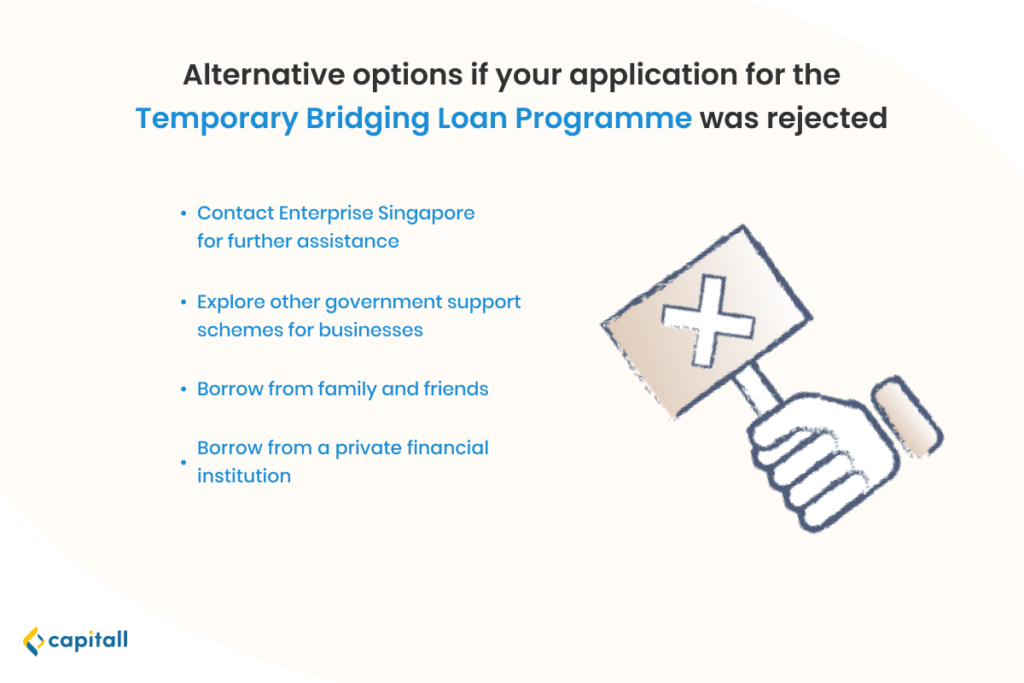

What You Can Do If Your Temporary Bridging Loan Programme (TBLP) Application Got Rejected

1. Contact Enterprise Singapore

If your TBLP application has been rejected, you can still get in touch with ESG at (+65) 6898 1800 or [email protected] for further assistance.

ESG might provide further help by sharing about other funding schemes that may be suitable for your business.

2. Explore Other Government Support Schemes

Besides the TBLP, there are other government support schemes for businesses that you can explore.

Let’s take a look at some of them.

Jobs Support Scheme (JSS)

The JSS provides support through payouts that are intended to offset local employees’ wages. This helps employers to retain their local staff (Singapore Citizens and Permanent Residents).

All employers who have made mandatory CPF contributions for their local employees qualify for the payout, with the latest JSS payout being in October 2020.

Under the JSS, the Government will co-funded between 10% to 50% of the first $4,600 of gross monthly wages paid to each local employee from September 2020 to March 2021.

IRAS should have notified eligible employers by post of the tier of support and the amount of JSS payout payable to them.

Jobs Growth Incentive (JGI)

The JGI encourages employers to hire from the local workforce by providing one year of salary support for each new local hire to their local workforce from September 2020 to February 2021. This is aimed at creating good and long-term jobs for locals.

The support is 25–50% of the first S$5,000 of gross monthly wages paid to all new local hires. Eligible employers will automatically receive their JGI payouts based on the employer’s mandatory CPF contributions. Eligible employers will start receiving the first JGI payout from March 2021 onwards.

With the JGI, you can expand and hire more employees while keeping staffing costs low.

SGUnited Jobs and Skills Package

This package seeks to expand job, traineeship, and skills training opportunities to Singaporeans impacted by the pandemic.

For example, 40,000 jobs were created in 2020, and the Workforce Singapore (WSG) will co-fund 80% of the qualifying training allowance in SGUnited Traineeships Programmes.

There are also many other incentives and programmes under this package meant to increase employment opportunities for Singaporeans.

Deferment Of Increase In CPF Contribution Rates For Senior Workers

To help employers manage costs, the planned increase in CPF contribution rates for senior workers have been deferred by one year to 1 Jan 2022. This will help lower your staffing fees.

Startup SG Founder Programme

This programme creates a platform for matching mentors to start-ups. It also funds first-time entrepreneurs with innovative business ideas by matching S$5 to every S$1 raised by the entrepreneur, for up to S$50,000.

If you are a first-time entrepreneur, you can consider this programme. Not only will you be able to secure funds for your business, you can also get valuable advice from experienced mentors.

Enhanced Training Support Package (ETSP)

Under this package, the government provides course fee subsidies and absentee payroll funding. This package is aimed at encouraging employers to send their employees for training during periods of downtime.

The ETSP provides an enhanced course fee subsidy at up to 90% for eligible employers in selected sectors for courses starting before 1 July 2021.

If you have been planning to upgrade the skills of your employees, why not tap on the ETSP to save on costs?

Enhanced Enterprise Development Grant (EDG)

The EDG was created to support the growth and transformation needs of Singapore companies. The grant supports projects under these pillars: Core Capabilities, Innovation and Productivity, and Market Access.

The maximum support percentage will be raised to 80% from 1 April 2020 to 30 September 2021.

Note that if you want to apply for this grant, you will need to submit individual project proposals with business plan details and project outcomes for assessment.

Productivity Solutions Grant (PSG)

The PSG supports companies that want to adopt IT solutions and equipment to enhance business processes. This is useful for sector-specific solutions such as in retail and logistics.

The maximum funding support level has been raised to 80% from 1 April 2020 to 30 September 2021.

Market Readiness Assistance Grant (MRA)

The MRA grant is targeted at SMEs that wish to expand overseas.

From 1 April 2020 to 31 March 2023, eligible SMEs can receive up to 70% of eligible costs. This will be capped at S$100,000 per company per new market. The MRA grant covers overseas market promotion, business development, and market set-up.

From 1 November 2020 to 30 September 2021, the maximum support level has been raised from 70% to 80%.

If you are thinking of expanding your SME overseas, you can consider applying for the MRA grant for extra support.

3. Borrow From Family And Friends

You can also turn to your family and friends for extra funding for your business. However, here are the advantages and disadvantages to note before doing so.

Pros

If you struggle with poor credit, it is much easier to borrow from people you know than from the banks, which have their own assessment system in place.

Borrowing from family and friends will also provide you with a more flexible repayment schedule as you can set up a grace period and set terms that are favourable to you.

This means that you may be able to enjoy lower interest rates than at banks. In fact, you might even be able to enjoy zero interest.

Your family and friends could also possibly stand to benefit from lending you money if you agree to share some of your business returns.

Cons

However, there can also be downsides from approaching your family and friends for money.

Firstly, private lending arrangements tend to lack clarity as they do not require the same legal documentation provided by banks. This means that misunderstandings can easily arise from different expectations.

Approaching family and friends for help can also cause them to prod on your spending habits. For example, they may criticise your purchases when you have not repaid your debts.

While certain levels of social awkwardness might be unavoidable, this can be mitigated by setting clear payment terms and sticking to them.

Here’s a quick sum-up of the pros and cons of taking a loan from family and friends for your business.

| Pros | Cons |

| – Flexible options – Lower or zero interest rates – Potentially a longer repayment period – Lender could benefit from business returns | – Potential lack of clarity and mutual understanding on loan terms – Could affect relationships with lenders who are your own family and friends |

4. Borrow From A Private Financial Institution

Another alternative to taking up the government’s temporary bridging loan is to approach private financial institutions such as Capitall for a business loan.

Here’s a look at how you can apply for one with Capitall and the advantages you can enjoy.

How To Apply

The loan approval process at Capitall is fast and simple. First, submit your enquiry on our website and an assigned relationship manager will be in touch with you to walk through the entire application process and assist with any questions.

After you have submitted all the required documents, your application will be processed quickly and the result will be sent to you shortly. Upon accepting the loan amount, you will need to go down to the outlet for verification and to sign the loan contract.

The whole process, from application to fund disbursement, can all happen within 24 hours.

The Advantages

There are several advantages of getting a loan at private financial institutions like Capitall than at banks.

For one, Capitall offers customised loan solutions and repayment options to meet your unique business needs.

At Capitall, transparency is also valued, so there are no hidden fees on any business loans. You do not have to worry about having hidden clauses that make you pay more than you expected.

One of the best parts of borrowing from Capitall is that funds can be approved and disbursed within 24 hours of your application.

If you are pressed for time, you can get a loan approved faster at a private financial institution than at a bank.

Being able to acquire funds quickly is a massive advantage that will allow you to quickly seize business opportunities.

Head over here to view our different business loan options that can be tailored to suit your needs.