An SME Loan Broker In Singapore Vs A Direct Lender: Differences You Should Know

You might have an impending need for extra working capital in your business. As you research possible sources for a loan, you might have come across the services of an SME loan broker in Singapore.

But what exactly is an SME loan broker? How can such a broker fit into your plan of getting a loan to propel your business forward?

Here we cover the following topics to give you a better understanding of what a loan broker is.

What Is An SME Loan Broker?

An SME loan broker in Singapore is also known by other terms such as business loan broker, mortgage broker, or business loan consultant. Regardless of the term, the services they provide are generally the same.

A loan broker is essentially a middle man that sources for the best loan deals to suit your business needs, advise on how to optimise your application, and help you successfully secure a loan from a lender.

It is the broker’s responsibility to compare various available loans that are most suited to your business needs. That said, it may not necessarily be in the broker’s interest to make the loan application on your behalf.

In short, having a broker is an extra step in the chain of a loan application before you approach the recommended lender.

How Can An SME Loan Broker In Singapore Help You?

You might be wondering, why would you need a loan broker when you can apply for a business loan yourself?

Well, you can easily brush aside the need for an SME loan broker if you’re a seasoned borrower with a strong network of potential lenders. Similarly, if your need for a business loan is not immediate, you probably don’t need a loan broker to do the research legwork for you.

Some borrowers, however, may find a loan broker’s services necessary, particularly if they are new business owners or novices in getting any type of business loans.

Having an SME loan broker is akin to getting a consultancy service that would help identify your business needs, recommend various relevant loan options, and perhaps even advise on ways to improve your company’s credit score.

As loan brokers typically maintain a strong relationship with an extensive network of lenders, they would be in a good position to advise on the best loan options for your business needs.

Working closely with banks and private financial institutions keeps loan consultants in the loop about the latest available loan products or promotional business loan packages. They can, therefore, help with loan rates comparison from different lenders, a task that new borrowers may find challenging to do on their own.

Apart from loan offers, a knowledgeable broker with years of experience could bring to the table advice on issues such as:

- Laws and regulations that could legally protect you as a borrower

- Fees imposed by lenders, aside from interest rates, that you might not be aware of

- Essential documents that could increase your chance of getting a loan

- Types of collateral required

What Hiring An SME Loan Broker In Singapore Would Cost You

Getting that expert input from a broker who has an eye across a large section of your market and industry, will put an extra cost in your whole loan application process.

While some loan consultants charge a flat fee for their services, others are paid commissions based on a percentage of the approved loan amount. The percentage could range anywhere from 3% to 6%. Payment is usually made after a service is completed, and the cost is paid for by the borrower.

Loan brokers may also factor variables into their fees, such as your financial position as an applicant, the loan size, and the complexity of your loan application. They may charge a higher broker fee if you have credit score issues, problems in cash flow, or missing documents in your application, as such circumstances demand more time and work from the broker.

Some brokers might also request a non-refundable processing fee upfront, to protect their position and ensure your commitment. However, this is not a common practice amongst loan brokers.

Here’s a table to sum up what an SME Loan Broker is:

| SME Loan Broker in Singapore | |

| Role | A middle man between borrower and lender |

| Responsibility | Consultancy Source and advise on best loan deals for the borrowerHelp to compare interest rates of various loans |

| Charges | Usually no upfront feesCharges 3% to 6% commission of approved loan amount (Some may apply a flat fee for their services) |

What Are Direct Lenders?

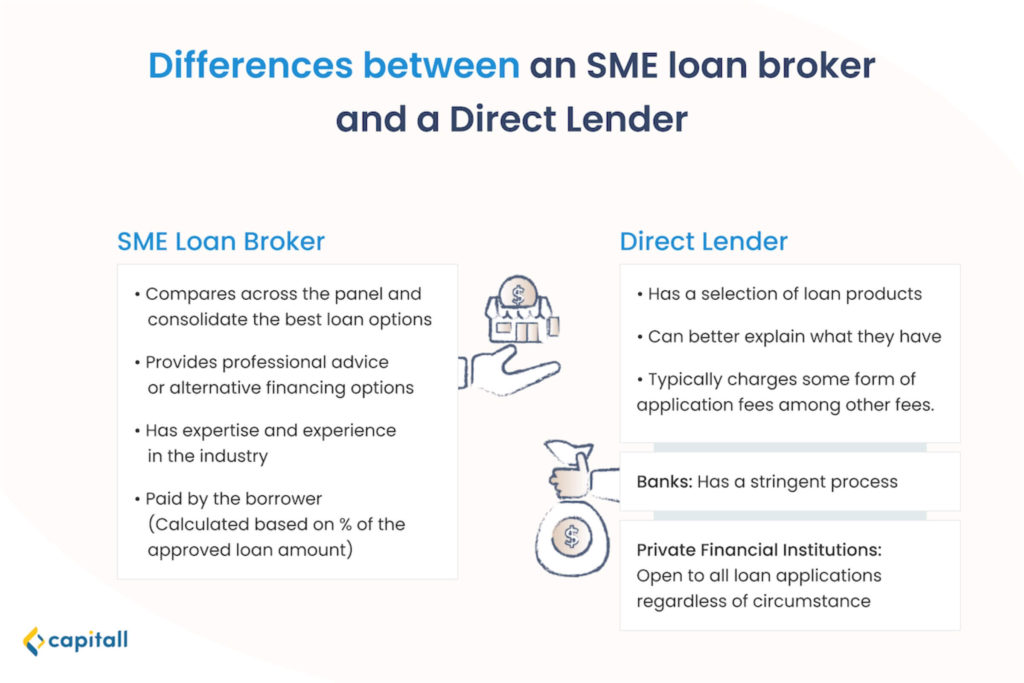

Direct lenders generally fall under 2 categories: banks or private financial institutions.

While an SME loan broker in Singapore provides consultancy on the business loan applications, it is the direct lenders who have the resources to provide the funding you need.

They have direct access to a wide range of loan products to offer. Conversely, loan brokers can only advise you on the availability of these products and how best to apply for them.

Banks

In assessing your loan application, banks would scrutinise your personal and business credit score, your business plan, financial projections, and revenue performance.

You can anticipate a smooth-sailing loan approval process if you have built a trusted relationship with banks and have no issues with your business’ cash flow or credit score.

However, do expect hiccups in the loan application if you’re in a complex situation such as:

- Having too many loans under your name

- Having poor personal and business credit rating

- Not meeting minimum requirements set by the bank

Private Financial Institutions

Private financial institutions are more flexible in assessing a loan application. They are usually open to providing you with the extra funding, even if your business is less than a year old. For example, private financial institutions such as Capitall provide financing for companies in operation for at least 10 months.

In contrast, you would find that banks might not even consider your loan request if your business is new with no substantial financial history or revenue performance to back the application.

SME Loan Broker And Direct Lenders: When Should You Approach Them For Business Loans?

Each business has its unique use for a business loan.

The benefits of getting an SME loan broker or applying straight to direct lenders depend on the nature, age, and performance of your business,

When To Approach An SME Loan Broker

SME loan brokers have an extensive network of lenders that offer various loan packages.

Some business owners might be irked by the thought of hiring an SME loan broker in Singapore due to the extra step and cost in a business loan application.

However, there are several circumstances in which you would find that getting the help of a loan consultant might be necessary:

- You Lack Experience In Applying For Any Business Loan

A loan broker would be able to assist you in giving an unbiased perspective on the pros and cons of multiple loan options.

- Your New Business Has No Substantial Revenue Performance

A loan consultant has the responsibility to advise on how your business could improve its chances of securing a loan, despite the lack of financial history and business plans

- You Don’t Have Time To Scout Around For The Best Business Loan Options

Outsourcing the search to an SME loan broker saves you time. You can focus on your business operations, while they consolidate suitable loan options to match your business needs.

- Banks Have Rejected Your Loan Applications

A loan broker could advise on an alternative strategy that could be helpful, especially if you are in a dire need for extra funds.

When To Approach Direct Lenders

Not every business would reap the benefits of getting an SME loan broker in Singapore. Direct lenders can offer lower rates, and you wouldn’t need to set aside a budget for a middle-man. If your business meets the following, approaching a direct lender may be a better choice.

- Your Business Has An Established Financial History

Usually, businesses with an established financial history and a proven track record would have forged a strong business relationship with direct lenders over the years.

- You Have Strong Personal Credit And Business Credit

If your business is new or doesn’t have a strong credit history, an SME loan broker might add value. Otherwise, they may not be able to provide insightful advice to your application.

- You Have A Solid Business Plan And/Or Financial Projections

Direct lenders are familiar with going through business plan operations, so they’d be able to quickly recommend a loan from their range of product packages if you have a clear business plan.