A Guide To Merchant Cash Advance And How It Works

With the economy in an unpredictable flux, it can be tricky navigating through these uncertain times as a business owner. Certain business decisions incur expenses that can put you in need of immediate cash. While a business loan might seem like a solution, the terms and conditions may not always meet your business needs. In times like this, you may want to consider a merchant cash advance instead.

Merchant cash advance, also known as a business cash advance, is an alternative financing option for your business. Though it is quick and relatively easy to apply, your business might need to meet certain criteria before getting a merchant cash advance in Singapore.

What Is A Merchant Cash Advance?

Similar to a business loan, a merchant cash advance provides quick funding to businesses to address their working capital needs. It is structured as a lump sum payment to your business, in exchange for a percentage of your future sales.

Its quick approval process and flexible credit requirements make it ideal for small businesses.

Is Merchant Cash Advance Suitable For Your Business?

A merchant cash advance is commonly used by businesses which derive their revenue primarily from debit and credit card sales. This includes retailers, restaurants, entertainment centres, and e-commerce.

This type of financing is suited for businesses that receive the majority of their payments by card. It is designed to provide businesses with a temporary cash-flow solution, making it a good alternative for business owners who might not be able to qualify for other types of financing.

Find out if your business is suitable for a merchant cash advance here.

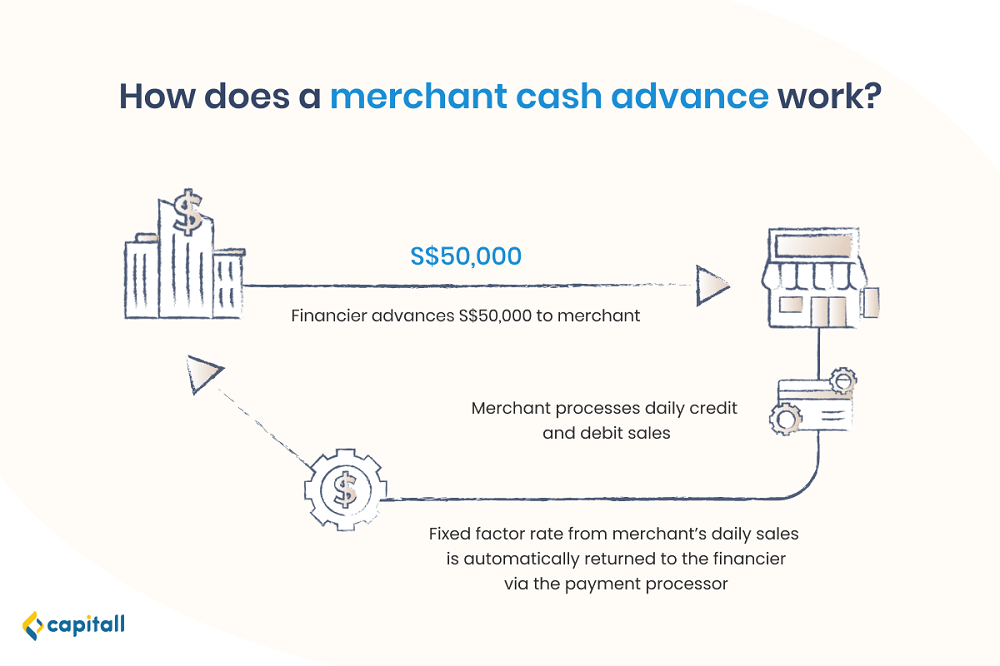

How Does Merchant Cash Advance Work?

A merchant cash advance works differently from business loans.

In business loans, you are loaned a lump sum, and you will have to pay the instalments based on your repayment schedule to your lender.

Whereas for a merchant cash advance, in return for an upfront lump sum advance, a percentage of your daily debit and/or credit card receipts are withheld to pay back your merchant cash advance. This is known as the “holdback”.

The holdback would fluctuate daily according to sales since the repayment is based on a percentage.

How Does The Lender Hold Back Your Sales Receipts?

You might be wondering — how does the lender take out money from your sales automatically, even before you’ve seen it?

This is carried out through your business’ credit card or payment processor.

Credit card processors often work in liaison with lenders that offer merchant cash advance, to make fund transfers more seamless. Sometimes, payment processors will provide merchant cash advance and funding in-house to complement their core business offerings.

Here’s an example. A retail business signs up for a merchant cash advance. The lender lines up their process with the retailer’s credit card processor, stating the daily holdback percentage. Remittance to holdback percentage is streamlined as credit card processes have direct access to the retailer’s sales.

Business Loan Vs A Merchant Cash Advance: What Are The Differences?

First and foremost, a merchant cash advance is not a loan as it is a sale of future revenue. It is considered an advance.

It is not subjected to scrutiny or regulations imposed on a business loan. This means that merchant cash advance is a seamless and fast way for merchants to get the funds they need. Instead of waiting for a business loan from a bank — which can take up to a few weeks to a month due to its stringent approval process, you can get the funds from a merchant cash advance in a couple of weeks or less.

It also does not have a traditional repayment schedule unlike most business loans, nor does it require collateral. This means you do not have to pledge any personal or business asset to take up the merchant cash advance. You won’t lose your property or car if you fail to repay the advance.

Personal and business credit scores also rarely play a part in whether you qualify for a merchant cash advance or not.

What are the types of business loan options available? Find out if they suit your business here.

How To Calculate The Cost Of Merchant Cash Advance

With its many pros, the merchant cash advance can, however, be more costly than other types of funding due to the chargeable fees. The fees are determined based on your ability to repay the advance.

Factor Rates

Calculating the cost for a merchant cash advance can be tricky. Fees are typically described as factor rates, instead of interest rates. A factor rate differs from interest rates in that it is not based on a particular time period.

In business loans, interest rates are calculated based on a percentage. However, in merchant cash advance, factor rates are a decimal figure. The factor rate is usually determined by the lender based on the risk assessment. A higher factor rate would mean a higher fee to pay.

Lenders decide on your factor rates by examining your company’s deposit, cash flow statements, and credit card processing to project your revenue. In addition, they may consider these factors:

| Factors | Details |

| Industry | Your industry presents varying levels of risk, e.g. sectors that routinely show periods of unpredictable high and low sales may get higher factor rates |

| Length of time in business | Your business needs to operate for at least 6 months. The younger the business, the higher the risk, the higher the potential factor rate |

| Business sales and growth | If your business generates consistent sales and has a proven track record of growth, it lowers the factor rate |

| Business credit history | The better your business credit history is, the lower your factor rate |

Total Cost Of Merchant Cash Advance And How To Calculate It

The cost of the merchant cash advance is based on the percentage of the original amount, and not based on the depreciating principle — it doesn’t matter if you pay off the advance in 3 or 6 months. The cost of the merchant cash advance will be the same regardless.

To calculate the cost of your merchant cash advance, multiply the cash advance by the factor rate to get the amount.

For example, a S$50,000 cash advance at a 1.20 factor rate is S$50,000 x 1.20 = S$60,000.

This means that you would be obligated to pay S$60,000 to the lender for advancing you the $50,000. The cost of the advance would hence be S$10,000 (20% of the amount borrowed).

Not eligible for a merchant cash advance? Or is a merchant cash advance unsuitable for your business needs? Capital offers business loans tailored to your needs. Reach out to our financial consultants for advice today.