Invoice Financing in Singapore: A Business Loan For SMEs

It is never easy having to rely on multiple clients for income. As reliable as they may be, no client is immune to the need for an occasional late payment request, especially in times of economic crisis like global pandemics or recessions. Neither is a 60-day invoice that you issued to a client going to hasten itself simply because you are in a cash crunch. Here’s where business loans can help.

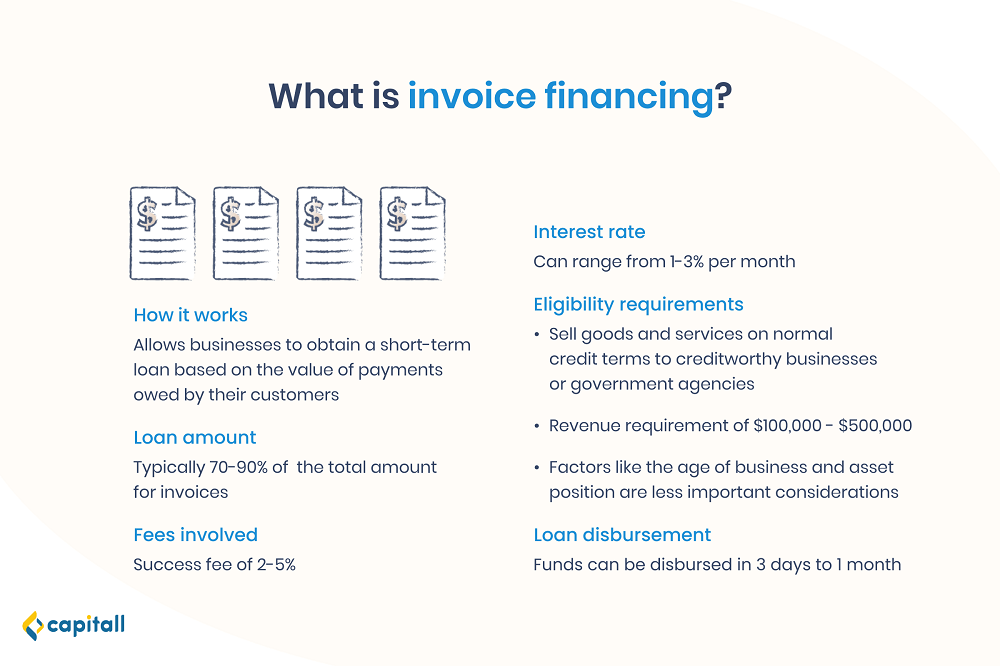

What Is Invoice Financing And How Does It Work?

If your business is highly dependent on external factors for its income, a single unpaid invoice could easily hinder the financial growth of your business.

It’s important to plan and ensure that your cash flow remains intact. Invoice financing in Singapore exists as an uncomplicated solution for this, allowing smaller businesses to remain operational through advancing on unpaid invoices.

There are 2 types of invoice financing that financial institutions in Singapore offer.

1. Invoice Financing Or Invoice Factoring

Invoice financing is also commonly known as invoice factoring. It is an alternative to traditional business loans. Banks and lenders issue these short-term loans by advancing your unpaid invoices and using them as collaterals.

Simply put, invoice financing allows businesses to get payments owed in advance. The process involves financing receivable accounts to third-party financial institutions.

With invoice financing, you can advance between 70% – 90% of your total invoiced amount, regardless of your client’s payment terms being 30, 60, or 90 days away. This allows SMEs and businesses to get almost instant cash on hand.

Here’s an example: you invoice your clients as you normally would. You then sell your invoices to a factoring company, which in many cases, is the financial institution.

These invoices are treated as collaterals and will entitle you to the advance a percentage of your total invoiced amount.

Your clients will then have to make payment to the factoring company instead. Once paid, the factoring company will pay you the remainder of your invoices (excluding fees).

2. Invoice Discounting

Invoice discounting is less commonly practised. It allows you to retain ownership of the invoices, unlike invoice financing.

After invoicing your clients, you can send the invoice slip to your lender. The lender will decide on a final percentage of the total invoiced amount to lend you. It will be disbursed to you in the form of a lump sum, or as a line of credit.

You can repay the loan lent to you, along with any interest and fees, after your clients have paid your invoices.

What Are The Fees Involved For This Type of Business Loan?

It is best to do your research before delving into getting an invoice financing plan for your business, as rates and fees vary based on lenders.

Success Fees

Some lenders charge success fees as a commission fee of sorts. They can also commonly be coined as “processing fees”, “set-up fees”, and “disbursement fees”.

It is seen as an incentive for the financial transactions they help put in place. In most cases, these fees fall in the range of 2% – 5%. Do take note, however, that fee structures vary based on who your lender is. Thus, you should always consult your lender and ensure the transparency of their fee structures.

Interest Rates

On average, interest rates for invoice financing can range between 1% – 3% a month and will be calculated until the date of repayment.

This is because of the lowered risk that lenders take with invoice financing. Interest fees of 1% – 3% are generally considered to be low for short-term financing options. Some lenders even offer complete discounts on interest fees if you repay the loan early.

What Are The Eligibility Requirements For Invoice Financing?

As with every business loan, eligibility requirements for invoice financing tend to vary based on lenders. Here’s a general overview:

1. Company Providing Goods Or Services

First and foremost, SMEs and businesses have to meet the basic criteria of providing goods or services on normal credit terms.

Your business needs to have invoices that are issued for goods or services that have been fulfilled. The only remaining part of the transaction between your business and your client is the payment.

Advancing invoices based on fulfilled orders help ensure that your ability to pay lenders back will not be affected by any disputes between you and your client.

2. Minimum Revenue Requirement

While invoice financing seems highly advantageous for small companies, as with any business loans, there is a minimum revenue requirement. Your business revenue will need to be of at least S$100,000 – S$500,000 a year.

This is to reduce the risk involved in invoice financing, making younger or smaller companies ineligible for the funding.

3. Operational Years

Though it may seem like all business loans have an operational history requirement for businesses, invoice financing, on the other hand, hardly takes that into account. Factors like the age of your business and its asset positions are more negligible considerations.

Financial institutions are more concerned with your repayment ability. The reality is that just like you, they are hoping that your clients pay up on invoices promptly too. So, as long as you have the invoices to prove an exchange of goods and services on credit terms, you do not need to worry if you are a new business.

Evidently, the eligibility requirements for invoice financing differ from normal business loans offered by banks and private financiers.

Here’s a glance at the differences:

| Invoice Financing | Business Loans | ||

| Banks | Capitall | ||

| Minimum annual revenue | S$100,000 – S$500,000 | At least S$300,000 | At least S$100,000 |

| Operational history | No requirements | At least 1 year, preferably 2 years | At least 10 months |

How Quickly Can You Get The Funds?

On average, you can get them within 3 days to 1 month. Invoice financing is a short-term loan. As such, funds can be disbursed in as quick as 3 days.

This makes it a great option for start-ups and SMEs that require immediate funding options, giving them space to focus on growing their business and managing other expenses.

For instance, a small-time caterer might rely on payment from invoices to purchase the ingredients and food for another event.

Is Invoice Financing The Right Type Of Business Loan For Your Business?

If you run an SME or a business, invoice financing could make a drastic difference in ensuring that your company’s progress is continuous.

But that doesn’t mean that invoice financing is a one-stop solution for everyone. The minimum eligibility of applying for invoice financing may make it out of the grasp of young, smaller start-ups.

But if you are a goods or service provider who does meet the requirements, invoice financing could be your solution to cash flow driven delays. These risk-free business loans will also keep you free of debt.