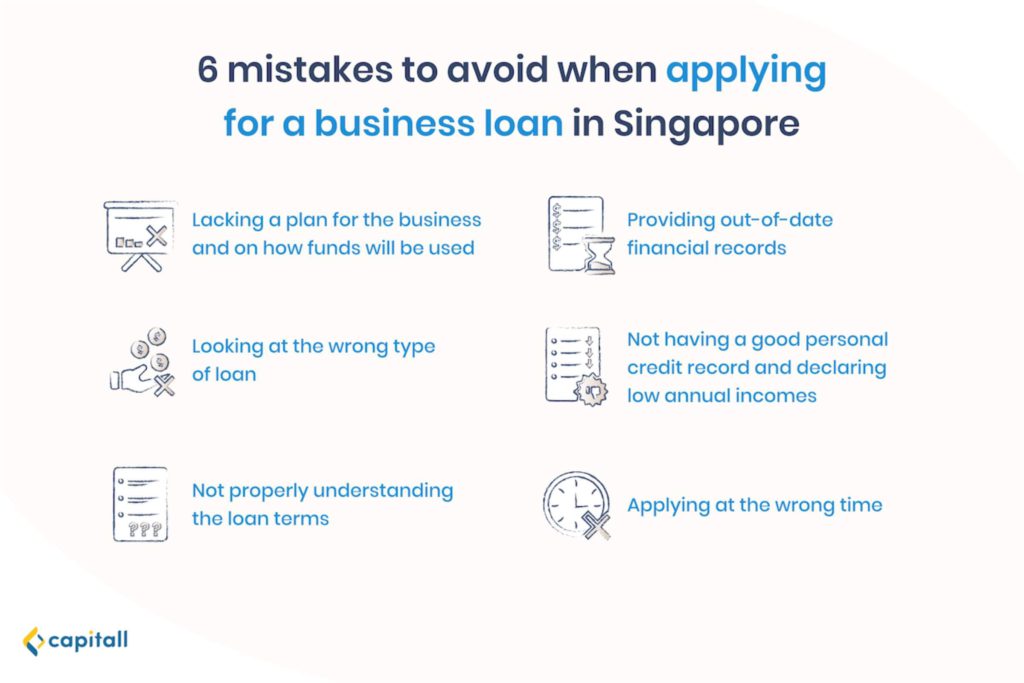

Avoid These 6 Mistakes When Applying For A Business Loan In Singapore

Starting a company can be a challenging feat. Not only must you have a good business idea, but you must also get enough capital. That’s not even considering all the countless administrative matters to handle.

The first part, getting a good idea, is often already established when the company is founded. However, most companies struggle to find financial backing to propel them to success.

And this is not uncommon. Many small enterprises encounter financial difficulties, especially at the beginning.

Luckily, there are ways to get the capital you need.

Financial institutions, which include banks and private companies, are often keen to provide business loans to businesses of all sizes. A timely business loan can provide the necessary funds for your business to truly take flight.

But how can you increase the chances of your lenders approving your loan?

To do that, avoid these 6 common mistakes that business-owners tend to make when applying for a business loan in Singapore.

1. Lacking A Clear Business Plan

When applying for a business loan, you should have a clear idea on how the money is going to be used. This means having a clear business plan even before sending in your business loan application.

Why is this important? Well, the lender needs to know that the money won’t be misused.

The financial institution that you’re applying to, be it banks or private companies, wants to know that you’re using the loan money to properly expand your business.

Improving the position of your business will increase your revenue. Having more money means that you can repay the loan amount to them.

If you lack a clear business plan, their confidence in your ability to repay the business loan will decrease. This will also reduce your chance of getting the business loan application approved.

That’s why it’s always essential to have a clear business plan when you apply for a business loan.

To increase lenders’ confidence in your business, be sure to clearly and succinctly explain how the loan will help boost your company and bring in revenue.

2. Choosing The Wrong Type Of Business Loan In Singapore

Have you ever gotten your loans rejected (despite having a clear business plan) and not know why?

It might be because the loan is unsuitable for your business needs. When the financial institution finds that your company applied for the wrong type of loan, they will reject your loan application.

The financial institution probably doesn’t feel confident that you can pay back the loan, given your business type and loan terms.

For example, a loan type that has high interest and short tenure is not suitable if you want to use the loan for a long-term investment.

There are many different types of business loans available, and each is meant for a different purpose.

Besides purpose, you should consider the loan terms and collaterals as well when applying for a business loan in Singapore.

Ensure that you can repay your loan payments. You won’t want to end up realising that the terms are highly unsuitable and struggle to meet the loan repayments.

Loans, after all, are meant to help ease your company’s financial difficulties—not add on to it.

Before applying for a business loan in Singapore, it’s best to compare the different types of business loans available to find out which one suits your business needs. Choosing the right loan will help with your business greatly.

3. Misunderstanding The Loan Terms

Sometimes, when applying for a loan, we might be in a hurry to submit it. We might be pressed for time or want the loan to be approved as quickly as possible.

However, rushing is exactly what you should avoid.

When applying for a loan, take your time to look through all the details and read the terms properly. We often miss the important details when we rush to complete something.

More importantly, give yourself time to think through all the terms. Make sure you can answer these 3 questions confidently:

- Have you read and understood all the details and loan terms?

- Is there anything surprising about the loan terms?

- Is there anything you’re not fully certain of?

Make enquiries on any doubts to ensure that you aren’t caught off-guard after the loan is approved.

You don’t want any hidden terms and conditions throwing a wrench into your plans in future. More importantly, you won’t want to realise much later that you can’t pay the loan repayments on time.

To prevent this from happening, give yourself ample time to read, question, and think through the loan application.

Once you are confident that you understand and agree with the loan terms very well, you can move to the next step of your application.

4. Providing Out-Of-Date Financial Records

Financial institutions rely heavily on information to assess whether they should lend you a business loan in Singapore.

Providing out-of-date financial records is going to decrease their confidence in your ability to repay the loan. Having detailed financial records makes it easier for the financial institution to check and approve your loan.

It’s recommended to invest some time to go through your financial records before submitting them together with the loan application.

5. Not Having A Good Personal Credit Record And Declaring Low Annual Incomes

Personal Credit Record

A good personal credit record is not just crucial for your personal finances—it can affect your business too. This includes business loan applications in Singapore.

If you are a company director with a poor credit behaviour, it can negatively impact your company’s credit assessment. A higher credit rating can increase the chances of getting a loan approval.

Avoid late payment of personal credit card bills and loan repayments, as these affect your credit assessment.

It also helps to check your credit score from the credit bureau before applying for a business loan. You can check it with either the Credit Bureau Singapore or the Moneylenders Credit Bureau.

Generally, improving your personal credit record is desirable. Not only is this beneficial for your company’s loan application, but it’s also beneficial for you when you apply for personal loans.

Declared Annual Income

Another thing to consider is your declared annual income. Low annual income figures can also affect credit assessment.

For most business loans in Singapore, directors are required to give personal guarantees. If there is a loan default, your financial institution may require payment from loan guarantors.

If you’re a company director and your declared annual income is low, the financial institution might be less confident in your ability to pay as a guarantor.

This might cause your loan application to be rejected.

Business loan application got rejected? These 5 reasons might explain why it got rejected.

6. Applying At The Wrong Time

Financial institutions are less likely to approve your business loans in Singapore if your business is still unstable. If your business still has high volatility in finances, you should hold off applying for a loan until your business stabilises.

When your financials are strong, financial institutions have more confidence in your ability to repay the loan. This incentivises them to approve your loan.

With this in mind, it’s a good idea to plan ahead. Most financial institutions look at bank statements from the past 6 months.

When your financials are at its strongest point, secure a loan for the next year first. Lenders will be more likely to lend you the funds then.

For small and medium enterprises who often experience seasonal transaction patterns, this is especially important. It’s a good idea to apply for business loans in Singapore after a period of high profit.

Here’s a summary of our pointers:

| Common Mistakes | Financial Institutions’ Perception |

| No clear business plans | Not confident that the company can repay the loan, as they’re unsure whether the loan will be managed properly. |

| Wrong business loan chosen | Loan is rejected as it is unsuitable for the company’s needs |

| Misunderstanding the loan’s terms | The company might suffer at a later date and not be able to meet the loan repayment |

| Providing out-of-date records | May negatively affect the assessment of your ability to paying back the loan |

| Not having a good personal credit record and declaring low annual incomes | Less confidence in your ability to pay back as a guarantor |

| Applying when your financials are volatile, or when you’re making losses | Less confidence in the company’s ability to repay the loan |

These 6 mistakes are often made by people when applying for business loans. By avoiding them, you can increase your chances of getting your loan approved—and more quickly, too!

Financial institutions such as banks might be more stringent when checking your financial record. Alternatively, you may consider private financial institutions such as Capitall, which provides business loans in Singapore, and at different conditions.

Now that you know how to increase your chances of getting a business loan in Singapore, remember to plan when to apply for the loan properly.

Ready to apply for a business loan? Apply now with Capitall!