What To Consider Before Buying An Asset Via Hire Purchase

Sometimes, an item we need may be too expensive for us to make full payment upfront. A hire purchase could be the right choice if you don’t want to tie your money down and prefer to have monthly repayments.

So what is the difference between a hire purchase, a leasing plan, and an instalment plan? Which is the best option for your business? In this article, we look at what hire purchase is and the factors to consider before signing a hire purchase agreement.

What Is Hire Purchase?

The hire purchase agreement is an arrangement to purchase pricey assets without paying the full lump sum upfront.

In a hire purchase agreement, you will pay an initial sum (known as a down payment), followed by regular monthly instalments. These instalments cover the leftover balance of the asset, as well as the interest charged.

Hire purchase is often used to purchase assets such as a fleet of cars or machinery needed for business operation. For example, a delivery company might require a fleet of motorcycles for their operation.

Some financial and business institutions use the term “instalment plan” interchangeably with “hire purchase”. However, the hire purchase definition may imply an essential difference: your ownership rights.

Some instalment plans will give you the rights to your asset immediately after signing the contract, while a hire purchase agreement transfers the ownership rights only when you’ve made the repayment in full.

Here’s a table to compare between the two:

| Hire purchase | Instalment plan | |

| Ownership | Ownership is transferred only on payment of the last instalment | Ownership is transferred at the commencement of the agreement |

| Termination | Both lender and hirer have the right to terminate the agreement and reposses/return the asset | Buyer has no right to terminate the instalment plan |

| Risk | Borne by the lender | Borne by the buyer |

| Right to sell | Belongs to the lender as they are the owners of the asset until it is fully paid for | Belongs to the buyer as he/she is the owner of the asset |

Read more about the benefits and drawbacks of hire purchase agreements here.

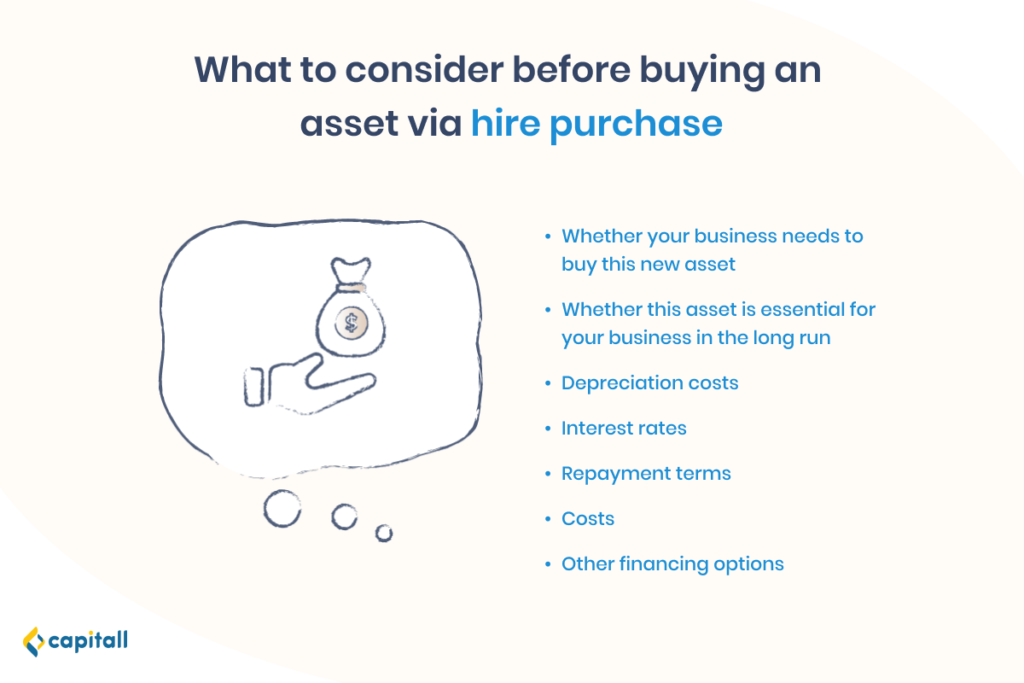

What To Consider Before Buying An Asset Via Hire Purchase?

Now that we’ve untangled the meaning of hire purchase, let’s look at what to consider before you sign a hire purchase agreement.

1. Does Your Business Need This New Asset To Thrive?

Before you go into a hire purchase agreement, consider the condition of your current assets. Do they need to be replaced? Can you resell them for some capital to fund your new assets?

Also, consider if it’s the right time to make this big-ticket purchase and if it’s within your means.

Ask yourself these questions:

- Will the new asset improve the efficiency of your business operation?

- Will the asset make your business more profitable?

If the answer is yes, that means you have the budget to make this massive purchase. Otherwise, remember never to invest too much money into unnecessary areas.

2. Is The Asset Essential For Your Business In The Long Run?

Hire purchases are long-term investments.

Firstly, hire purchases — especially for cars — can last up to 7 years. If you only need the asset for a year or so, consider leasing instead.

Leasing will be a better option as you can end the contract early and return the asset to the seller when you no longer need it. Do not that you may have to fork up an early termination fee. However, some leasing companies may allow you to ‘transfer’ your lease over to another company without financial penalty. So bear in mind to check out your leasing terms.

Secondly, consider the pace of technological developments in your industry. If your industry sees rapid improvements in available equipment, you might want to consider a lease.

3. Depreciation Costs

Assets such as cars and heavy machinery depreciate over time.

At the end of your hire purchase agreement, your asset might not be as useful either because it’s no longer functional, or that there’s a better model out in the market.

At this point, you may have to resell the asset at a much lower price than the initial sum plus accumulated interest.

The question to ask yourself is if this depreciation cost is negligible or justifiable in the long run. You will need to take this into account when considering the hire purchase agreement too.

4. Interest Rates

The next thing to consider is the interest rate of the hire purchase agreement.

If you sign a hire purchase agreement for a new vehicle, the lender usually caps the loan at 70-80% of the total cost.

So, if you’re getting a S$187,500 vehicle, you may need to pay the upfront amount of S$37,500.

Let’s say that the remaining S$150,000 have an interest rate of 4%. That means the annual interest is S$6,000.

If the tenure is 7 years, you’ll have paid S$42,000 in interest at the end of the tenure.

Add that to the vehicle’s initial price, and you’ll have paid S$192,000. That’s 28% more than the initial price. Consider if you are willing to bear this additional interest cost in a hire purchase agreement.

Be sure to compare interest rates from various financial institutions to get the best rate.

Also, assets with a higher resale value, such as agricultural equipment, cars, or machinery, entail better interest rates. Conversely, furniture or office equipment have a lower resale value, meaning that their interest rates may be higher.

As a business owner, you should look for a business loan that caters to your needs. We cover some of the business loan options here.

Looking for auto-financing loans? Here’s an in-depth guide.

5. Repayment Terms

Before entering any loan contract, make sure that you can meet the monthly repayments.

Based on the example above, you’ll need to pay about S$2,300/month. This can be a significant recurring sum if your company is struggling financially.

Remember that you can incur penalties for late payment, which will add to the monthly instalment.

If you are not diligent about repayments and default on your loan, the seller will repossess your asset, and you will stand to lose the money you have fronted. If you cannot keep up with the instalment plan, other available options such as assigning the contract to another person are available.

6. Costs

Remember that payment for hire purchase agreements, or any loan, is spread out over time. A longer tenure will mean paying interest for more months, resulting in higher costs in the long run.

But here’s the silver lining: hire purchase agreements are an expense for your business, so they are tax-deductible. You can write off taxes to save some money.

7. Other Financing Options

Not sure whether to go for a hire purchase agreement? There are other financing options to help you fund your business assets.

Business loans, for instance, are just as useful and have many advantages. Unlike hire purchases, you can use your business loan for all your company needs, including payroll, daily operations, or paying vendors.

Business loans do not limit the use of the funds either, giving you greater flexibility to run your business’ financial aspects. You can use the business loan to capitalise on business opportunities, expand your business, or upgrade your inventory.

Another benefit of taking on a business loan to fund your big-ticket purchase is that you own the asset.

Owning the asset immediately instead of owning it in a few years’ time plays a huge difference, especially if you plan to resell it.

Thinking of taking a business loan? Here are 6 reasons why SMEs take up business loans in Singapore.

Getting A Suitable Business Loan In Singapore

Don’t let the lack of cash limit your company’s business growth. Capitall provides quick business funding of up to S$300,00 within 24 hours of application. Talk to us today to find out how we can bring your business to newer heights.