A Guide To The Temporary Bridging Loan Programme (TBLP)

Is your business looking for short-term financing support to alleviate its cash flow needs? The Temporary Bridging Loan Programme (TBLP) can open up access to more working capital for your business, helping it bounce back stronger.

As a bridging loan, the TBLP provides immediate cash flow via a fast application and approval process, thus allowing you to meet your current business obligations.

What Is The Temporary Bridging Loan Programme (TBLP)?

The TBLP, which provides businesses with access to working capital, was first introduced in Budget 2020 for enterprises in the tourism sector. These businesses could borrow up to S$1 million, with the interest rate capped at 5% per annum.

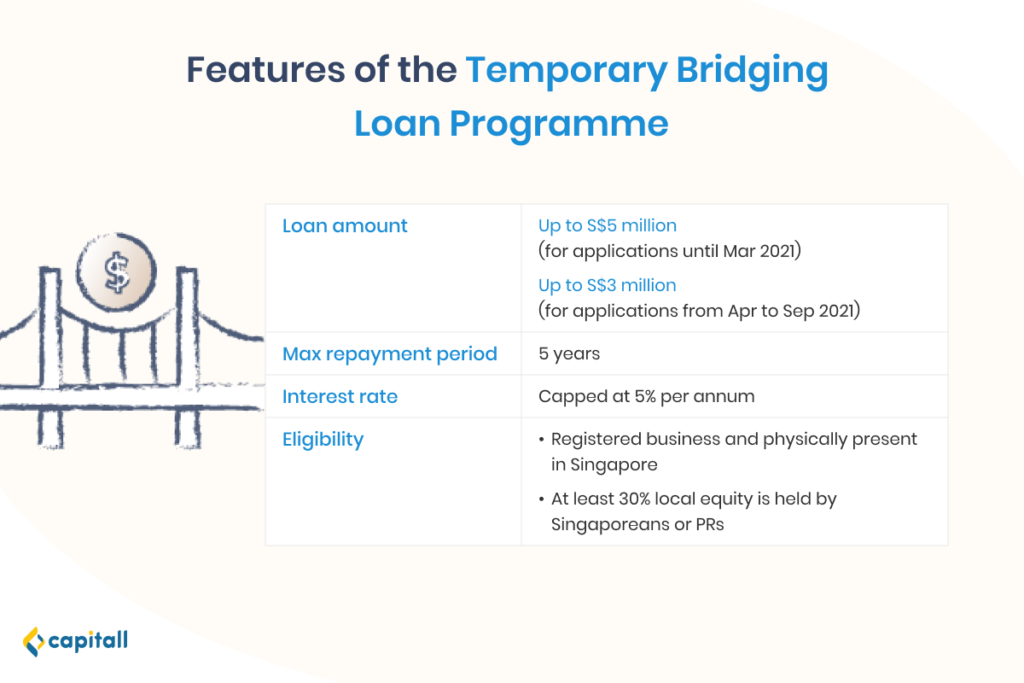

The TBLP was later expanded to be available for all sectors from 1 April 2020 to 31 March 2021. Enterprises can borrow up to S$5 million, with the interest rate capped at 5% per annum.

An extension was then announced in October 2020 that applications for the TBLP would also be extended from 1 April 2021 to 30 September 2021. However, the maximum loan amount will be lowered to S$3 million for applications made during this period.

To apply for the TBLP, businesses can approach the participating financial institutions including major banks in Singapore. No collateral will be required for the loan.

What Are The Eligibility Criteria?

To apply for the TBLP, enterprises must be an ACRA-registered business entity. This includes the following enterprise types:

- Sole proprietorships

- Partnerships

- Limited liability partnerships

- Companies

The business entity must also be physically present in Singapore, with at least 30% local equity held by a Singaporean and/or Permanent Resident.

Similar to other types of loans, approval of the TBLP are subject to assessment by the participating financial institution.

Other Details To Note About The Temporary Bridging Loan Programme (TBLP)

One thing to note is that you may apply for the TBLP from more than one of the participating financial institutions, giving you more flexibility and options.

However, for applications submitted until 31 March 2021, the total amount you can borrow from the various financial institutions under the TBLP is capped at the maximum amount of S$5 million.

Here are more details to take note about the TBLP:

| Application period | From now until 31 March 2021 | 1 April 2021 to 30 September 2021 |

| Sectors | All sectors | All sectors |

| Maximum loan amount | S$5 million | S$3 million |

| Interest rate | Capped at 5% p.a. | Capped at 5% p.a. |

| Risk share | 90% | 70% |

Maximum Loan Amount

For loan applications submitted from now till 31 March 2021, you can get a loan of up to S$5 million from the various participating financial institutions.

On the other hand, for applications made between 1 April 2021 and 30 September 2021, the loan amount will be capped at S$3 million.

Maximum Repayment Period

Repayment for the TBLP can be spread out for a maximum of 5 years.

Interest Rate

Risk Share

For loan applications made by 31 March 2021, the government will be taking on 90% of the loan risk.

This risk share will be lowered to 70% for loan applications made between 1 April 2021 and 30 September 2021.

Should a business default on the loan, the lender would still take action under its standard commercial recovery procedure to recover the repayments.

However, if the lender fails to recover the repayments, it can claim the unrecovered amounts from Enterprise Singapore in proportion to the risk share.

For instance, a business takes a loan of S$1 million under the TBLP and defaults on it. The lender will first follow through on its standard commercial recovery procedure before claiming from Enterprise Singapore.

If only S$400,000 is recovered from its standard commercial recovery procedure, the lender will be able to make a claim of S$540,000 (90% of the remaining S$600,000) from Enterprise Singapore if the loan is applied for by March 2021.

Deferment Of Principal Repayment

To help reduce monthly cash outflow, businesses can request to defer their principal repayment for up to 1 year, subject to the financial institution’s assessment.

What Can You Use The Temporary Bridging Loan For?

As the name suggests, temporary bridging loans are of a short-term nature. Nonetheless, they can serve several business purposes.

Immediate Expenses

Bridging loans can be used for immediate expenses, such as if equipment or machinery break down suddenly. If you have not set aside funds for such machinery replacements, the TBLP could help you through such unexpected situations.

Learn more about how a bridging loan can help your business here.

Interim Financing

Bridging loans can also help cover business expenses in the interim while your business is waiting for long-term financing. This helps to resolve any cash flow problems in the meantime.

Cash Flow Issues

Businesses can also opt for bridging loans to alleviate temporary cash flow difficulties. If your business requires interim support, you can opt to apply for the TBLP to get working capital to cover your company’s payroll, as well as short-term expenses like rent, marketing, utilities, inventory, and other urgent expenses.

Expansion

Temporary bridging loans are also useful for funding your company’s expansion plans. This includes relocating or moving offices, as well as purchasing new equipment to cope with your business expansion needs.

Find out more about how the TBLP can help sustain your business here.

What Are The Documents Needed For The TBLP Application?

To apply for the TBLP, you will need to submit the completed Enterprise Financing Scheme (EFS) e-form with the necessary supporting documents to the participating financial institution.

You will be required to include the following details in your e-form:

- Company information, including paid up capital and percentages of revenue derived from the production of goods or services

- Details of shareholders of your business entity and all corporate parents

- Past financial performance and financial projections

- Details on the loan required, including the amount of financing required

In addition, you will need to submit the following supporting documents:

- Latest ACRA search of your business entity

- Latest ACRA search of corporate shareholders (if the corporate shareholder(s) hold more than 50% of total shareholding)

- Latest 1-year financing statements

- Asset invoice (if any)

- Any other documents specified by the financial institution

Will Your Company’s TBLP Application Be Approved?

Despite the high risk share and approval rate, TBLP approval success is subject to a number of factors. Businesses with weak cash flow, are overleveraged, or have prior records of loan defaults have lower chances of loan approval.

What Happens If Your Company Is Not Eligible For The Temporary Bridging Loan Programme?

If your company is not eligible for the TBLP, consider approaching alternative financial institutions such as Capitall for help.

At Capitall, loan applications are fuss-free and can be done online. Plus, you can receive your business loan in just 24 hours. Ready to apply for a bridging loan? Apply now with Capitall.