How Much Should You Get For Your SME Working Capital Loan

If you’ve been following this space, you would know that we’ve been discussing what working capital loans are and how they can benefit SME businesses. Working capital loans help SMEs finance day to day operations and provide short term solutions to pressing challenges such as seasonal fluctuations and downturns.

Perhaps your business needs to take a working capital loan to deal with cash flow challenges or fluctuations. How should you go about applying for your loan? What is the sum you should apply for? And what other factors should you consider?

Here, we will discuss the answers to these practical concerns and how you can calculate your business working capital.

What Is Working Capital?

Working capital is used to pay short term obligations. Your accounts payable, your employee’s payroll, your rental, equipment, and stocking up inventory are just some of the many aspects that fall under working capital.

Whether you’re a small business or a global one, having good management of your working capital is vital. If your working capital dips too low, you risk poor cash flow and insufficient funds. You might be caught up in a scenario where you do not even have enough funds to keep your business up and running.

Good management of working capital is of paramount importance and will continue to be a challenge for most businesses. Even profitable businesses can run into trouble if they lose the ability to meet their short-term obligations.

As such, having enough funds to keep your business running is crucial. Without sufficient working capital, it’s impossible to address other challenges your business is facing.

How To Calculate Your Business Working Capital

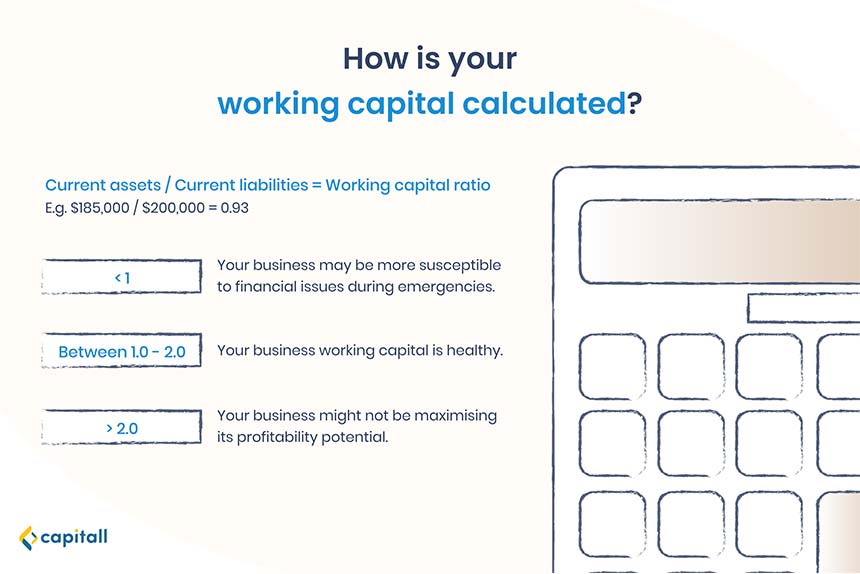

Before you take a loan, it’s important to first know what your working capital ratio is. How do you go about calculating it? You can calculate your business working capital by using the working capital ratio. It’s pretty straightforward–here’s an equation you can follow:

“Working Capital Ratio = Current Assets / Current Liabilities”

By dividing your assets with your liabilities, you will be able to work out your working capital ratio. Working capital ratio is usually explained in 3 categories and here’s what the figures indicate:

| Figure | Sign | What it means |

| Above 2.0 | Positive working capital | – Your company has more current assets than current liabilities. – Your company can fully cover short-term liabilities within a period of time. – You may have an excessive amount of surplus you’re not utilising to invest in new ventures. |

| Between 1.0 – 2.0 | Zero working capital | – Your company is doing fine. – Your current assets could be fully funded by current liabilities. You have the ability to repay short-term debts. |

| Lower than 1 | Negative working capital | – Your current liabilities exceed the current assets. – Your company is considered risky as you might not be able to cover your debt if needed. – Your company might face difficulties repaying short-term debts as your liabilities exceed your assets. |

Calculating your working capital ratio can help you make a better decision on the direction of your business.

Businesses with a negative working capital might need to take a loan to cover day-to-day operational costs to give themselves a cash flow boost.

Whereas for businesses that have a positive working capital figure, launching new ventures and expanding might be something you should head towards. Taking a working capital loan would make sense for these businesses as going to new ventures requires access to a larger pool of funds.

As you can see, working capital ratio can serve as an indicator of how well your business is doing. When there is too much working capital, it may mean that you are being too conservative with your finances. On the other hand, having too little working capital is a warning sign that you might be too aggressive with your finances.

Why Should Businesses Take SME Working Capital Loans?

Taking a loan does not necessarily indicate that your business is faltering. It also does not mean you are adding more burdens to your business.

In fact, there are many benefits businesses can gain from taking loans at the right time. Here are some of the most common reasons why SMEs take a working capital loan.

To Combat Cash Flow Problems And Finance Daily Operations

Having sufficient cash flow is vital for all businesses. Cash flow problems do not just stem from economic downturns of cyclical fluctuations. At times, it could be a product of expansion and growth as more funds are being set aside for new ventures.

Many SMEs face problems with cash flow and often need access to funds in challenging times.

Before businesses can come up with new strategies to diversify or solve problems in the long run, they will first need to attend to the most immediate concerns. Being on top of operational costs is crucial for businesses to continue running.

Having a working capital loan will help ease the burden and allow business owners to focus on coming up with new strategies to cope with the root problems their business is facing.

To Prepare For Unexpected Situations

Sometimes, unforeseen circumstances can hit businesses badly. Political turmoil or sudden changes in governmental policies can cause prices of supplies to spike unexpectedly.

These factors are often outside of the business’ control, and SMEs have no choice but to adapt to these changes.

In times like these, it’s important to have a ready pool of emergency funds. Loan applications are generally more easily approved when your business is doing well. As such, getting a loan when the business is going fine is a great idea because it keeps you prepared.

Want to learn more about why SMEs need working capital loans? Read more about it here.

What To Note When Getting An SME Working Capital Loan

The first thing people think about when it comes to taking up a loan is the interest rates. Yes, interest rates do play a big part in helping businesses decide who they should borrow funds from. Depending on your SME’s profile and credit analysis, interest rates can vary.

That said, interest rates should not be the only aspect to consider when taking a loan. Different financial institutions have different requirements for the seemingly similar loans they offer.

Besides comparing interest rates, you should also consider the tenure period, monthly instalments, hidden fees, and processing fees. A financial institution might offer lower rates but high processing fees and other hidden fees, resulting in higher costs for you. Unlike other financial institutions, Capitall adopts a transparent structure, so you can be assured that there are no hidden fees on any of their business loans.

Additionally, you should also consider penalty fees and loan extension plans if you’re planning on taking a hefty sum of loan.

It’s always important to know the policies and requirements of different financial institutions before you decide to take a loan.

Taking A Working Capital Loan

Taking a loan might sound like an intimidating, perhaps even complicated process. But as long as you identify the type of loan you need, how you will use the funds, and how much you should borrow, it can be a straightforward process. With Capitall, you can obtain a working capital loan for your business within 24 hours.

In situations like these, it’s important to get a loan that suits your business goals. The last thing you want is to take a loan only to realise that it adds more financial burden to your business.

Reach out and speak to financial advisors at Capitall today!