All About Hire Purchase Agreement For Car Loan And The Regulations In Singapore

Buying a car with a hire purchase agreement is not uncommon in Singapore. After all, Singapore has one of the highest costs of owning a car in the world.

The good thing about hire purchase is that it allows you to pay the car in instalments, helping you spread the cost. However, it comes with the risk of having your car repossessed if there is a payment default.

When exactly is it legal for the lender to repossess your car? Can the lender still seize your car if you paid your instalments 7 days late?

This article outlines the rights and regulations you need to know about the hire purchase agreement.

How Does Hire Purchase Work?

Hire purchase is a type of payment arrangement that allows people to buy something without making the full payment upfront. It can be considered a loan as the remaining balance and interest are paid over a period of time.

Under a hire purchase agreement, the lender buys the car from the seller, after which they will loan it to the hirer. The hirer will then have to repay the amount in full before gaining ownership of the car.

This also means when the hirer defaults on the loan, the lender has the right to repossess the car. Besides payment default, any breaches of the terms in the contract can result in the car’s repossession.

To avoid this, it is essential to understand how hire purchase is regulated in Singapore.

How Is Hire Purchase Regulated In Singapore?

The Hire-Purchase Act (HPA) outlines the rights and responsibilities of both the hirer and the lender to protect them.

Conditions And Warranties

Some conditions and terms take note in the HPA include:

- The hirer has quiet possession of the goods, meaning they have the right to use the car as they please.

- Third parties cannot hinder the hirer’s use of the goods.

- The goods under the hire purchase agreement should be merchantable and fit for use. This also means that you should bring up any defects noticed when given the chance to inspect the car. Afterwards, the lender shall not be liable for any other defects.

- Your car has to be reasonably fit for its intended use.

- The lender cannot misrepresent the condition and functionality of the car to the hirer.

Hire rights under the HPA

Under the HPA, the hirer has the following rights as well:

- The hirer can ask for information on the hire purchase agreement, including but not limited to the copy of the contract, the paid sum, and the remaining balance from the lender.

- The hirer can transfer the hire purchase rights to another person, who will take over the hire purchase agreement, thus becoming the hirer.

- The hirer can also pay the remaining net sum early in one lump payment to gain the car ownership ahead of schedule.

- The hirer can return the car and cancel the contract. However, this also means losing the money already paid, with the possibility of incurring a termination fee.

In addition, the hire purchase agreement stipulates some obligations, such as:

- Accepting the delivery of the vehicle

- Timely repayments at agreed intervals

- Ensuring the vehicle is kept in good condition

- Informing the owner of the location of the car upon request

Should you breach one or more of these terms, your lender has the legal right to terminate your contract. Your lender can also repossess your vehicle if your hire purchase agreement includes such a disposition. Repossession usually occurs when there is late payment or payment default.

What Requirements To Take Note To Be Protected Under The HPA

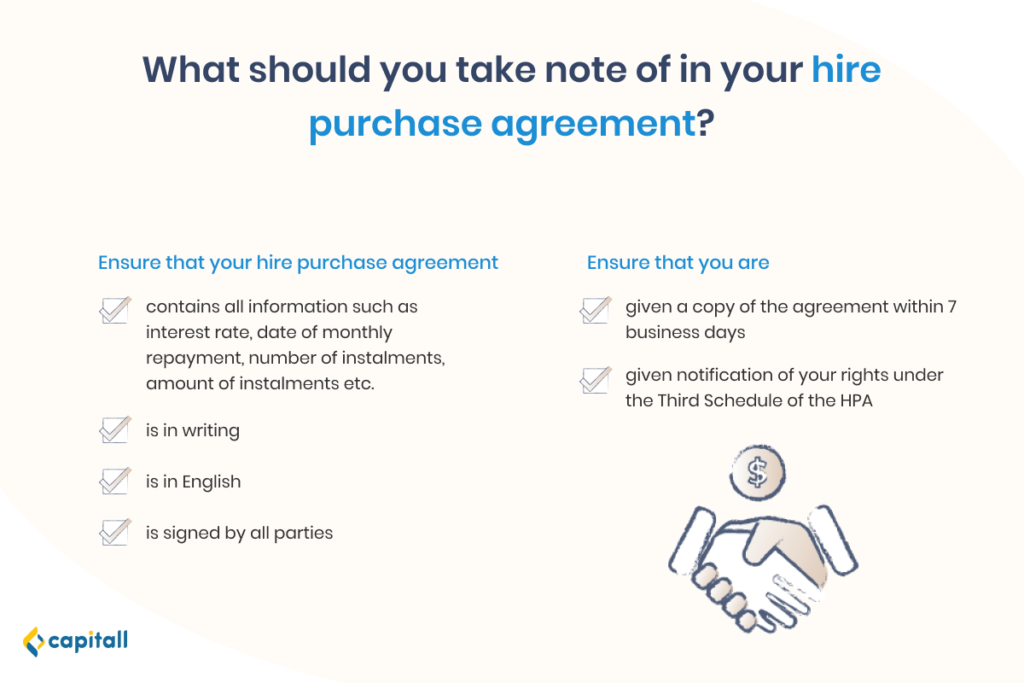

To ensure you are protected under the HPA, be sure to note the following requirements:

- Your hire purchase agreement has to include all the necessary information that the HPA requires. This includes the price of the vehicle, interest rates, payment dates, amount and number of instalments, fees, total amount payable, starting date of instalment payments, and early settlement agreements.

- The hire purchase agreement has to be written in English.

- All contracting parties must sign the agreement.

- As a hirer, you have to receive a copy of this contract within 7 working days.

- You must be informed of your rights under the Third Schedule of the HPA, including the right to request in writing for a copy of the agreement and statement of account.

What Happens If You Cannot Continue Paying For Your Hire Purchase Loan?

Calculate The Car Loan Beforehand

Hire purchase agreements work like most loans. Similar to taking a personal loan or a business loan, you will need to ensure that you can afford it before signing the contract.

Here’s how the car loan is calculated.

Down Payment And Loan Amount

The down payment and loan amount depend on the Open Market Value (OMV) of the car.

| OMV | Maximum loan-to-value (LTV) | Maximum loan tenure |

| Less than or equal to S$20,000 | 70% | 7 years |

| More than S$20,000 | 60% | 7 years |

Let’s say the OMV of the vehicle is more than S$20,000 and has a purchase price of S$140,000.

With an LTV of 60%, the down payment is 40% at S$56,000, while the loan amount will be S$84,000.

Interest

Hire purchase agreements come with a flat interest rate. If your interest rate is 2.9%, you will have to pay S$2,436 per year.

If you take the maximum loan tenure of 7 years, the total interest adds up to S$17,052.

Monthly instalments

The loan amount and total interest amount to S$101,052.

Based on this total amount, the monthly instalments will be S$101,052 / (7 ⨉12) = S$1,203

Be sure to check if the down payment and monthly instalments are within your means.

Learn more about how to ensure you are financially ready to get a car loan in Singapore here.

If you cannot make the full repayment, you will be in breach of the contract. The lender has the legal right to terminate the agreement and may repossess your car.

Other Implications For Failing To Make The Full Repayment

On top of the risk of having your vehicle repossessed, here are some implications to take note.

Loss Of Money Paid

You will not be able to get back the sums already paid in instalments. You may even be required to pay a termination fee.

Legal Proceedings

Should the lender believe that you have the money to repay the loan, but refuse to pay for it, they can initiate legal proceedings.

This usually starts with a legal warning letter sent to you, if you have not made any payments in more than 30 days. The legal proceedings may start earlier if the lender finds out you are planning to leave the country.

Employment Difficulties

Loan defaults will appear on your credit report indefinitely, especially if there is no attempt to negotiate or settle it.

In some industries such as finance, having a poor credit history may make it harder to land a job.

No Access To Crucial Loans

Lenders are less willing to approve loans for those with a history of loan defaults. This makes it harder to get essential loans, such as home loans. It is also why it is recommended to get a house first before buying a car.

Capitall’s Hire Purchase Loan

Need funds to purchase a car? Whether it is for personal or business use, getting a hire purchase loan is not as hard as it seems.

Offering hassle-free applications and fast approvals within one business day, Capitall is here to help you fund your car purchase.