Ultimate Guide To Car Loan Balloon Payment Schemes

The convenience of having your own car would drive you to hunt for the best possible car loan. In looking to finance your car purchase, you might have been offered the balloon payment scheme as an option.

But is the scheme right for you? Would you be better off with a conventional car loan?

Before jumping into a decision, let us take a closer look at what the balloon payment scheme really is and how it works.

Want to learn more about financing your car? Read this guide on auto financing loans.

What Is A Balloon Payment Scheme For A Car Loan?

The downpayment that you have to fork out for your car depends on its Open Market Value (OMV), which is the actual price of the car before taxes are factored in. The remaining amount will then need to be financed by a car loan.

For cars that have an OMV of up to S$20,000, the maximum loan amount you can take is 70% of the car’s purchase or valuation price. For cars with OMV exceeding S$20,000, the maximum loan amount is 60% of the car’s purchase or valuation price.

A balloon payment scheme is designed to lower the monthly instalment payments made to lenders. Such a scheme could appear attractive especially to first-time car buyers.

The reason you pay less in monthly instalments is because the minimum Preferential Additional Registration Fee (PARF) rebate portion of your car is excluded from the total loan amount.

But before you get geared up for a balloon payment scheme, do bear in mind that the interest for it is usually higher than that of a typical car loan.

How Does A Balloon Payment Scheme Work?

To give you a better idea of how your monthly instalments would look like in a balloon payment scheme versus a conventional loan, let us look at an example of a car that costs S$100,000.

If you place a downpayment of S$40,000, that leaves a figure of S$60,000 as your principal loan amount.

Here is a comparison of what you can expect to pay for monthly instalments in a typical car loan against that of a balloon payment scheme:

Conventional Car Loan

The interest for a normal car loan from most banks ranges from 2.5 to 3%.

Assuming the interest rate is 2.5% and a loan of S$60,000, your total interest payable for a 5-year loan tenure would be:

(S$60,000 x 2.5%) x 5 years = S$7,500

For a 5-year loan, the total loan amount including interest you have to pay is:

S$60,000 + S$7,500 = S$67,500

Your monthly instalment for 5 years (i.e. 60 months) is:

S$67,500 / 60 = S$1,125

Balloon Payment Scheme

Now compare the above figures with that of a balloon payment scheme.

Under this scheme, the PARF value plays a part in the loan calculation. For illustration purposes, let us put the PARF value at S$10,000.

The interest for this scheme is usually higher than a typical car loan. Assuming the interest rate is 3.75% and a loan of S$60,000, your total interest payable for a 5-year tenure would be:

(S$60,000 x 3.75%) x 5 years = S$11,250

The total loan amount that includes interest but excludes the PARF value is:

S$60,000 + S$11,250 – S$10,000 = S$61,250

Your monthly instalment for 5 years (i.e. 60 months) is:

S$61,250 / 60 = S$1,020

Comparing the conventional car loan and the balloon payment scheme, you can see that the monthly instalments for the balloon payment scheme is lower than that of a conventional car loan.

However, the catch is that under the balloon payment scheme, your last loan instalment will include the PARF rebate portion. This means the total repayment amount for that month would be S$11,020 (S$10,000 + S$1,020).

What Is PARF And How Is It Calculated?

Buying a car in Singapore is notoriously expensive because there are lots of components that go into the cost.

This includes the PARF and ARF (Additional Registration Fee). To understand how PARF is calculated, you first need to know about the ARF.

Registering a new car in Singapore starts with the flat RF that currently stands at S$220. Next is the ARF, which is another tax charge calculated based on the OMV of the car.

Since March 2013, a tiered ARF system was introduced for all newly-registered cars:

Additional Registration Fee (ARF)

| Vehicle OMV | ARF rate |

| First S$20,000 | 100% |

| Next S$30,000 (i.e. S$20,001 to S$50,000) | 140% |

| Remaining above S$50,000 | 180% |

Source: sgCarMart

If we take the example of a car that has a OMV of S$70,000, the ARF calculation would be:

ARF For A Car With An OMV Of S$70,000

| OMV | ARF payable |

| First S$20,000 | 100% x S$20,000 = S$20,000 |

| Next S$30,000 | 140% x S$30,000 = S$42,000 |

| Above S$50,000 | Since the OMV is S$70,000, the 180% is imposed on the remaining S$20,000: (S$70,000 – S$20,000 – S$30,000) x 180%= S$20,000 x 180% = S$36,000 |

The total ARF to be paid will be S$20,000 + S$42,000 + S$36,000 = S$98,000.

Calculating The PARF Rebate

Whether your car is registered locally or overseas, its age is based on the date that it is registered.

In addition to the amount paid on ARF, your car’s age at the time of deregistration will also determine how much PARF rebate you will get.

Here is the PARF rebate to expect based on the age of the car at registration:

| Age Of Car | PARF Rebate |

| Less than 5 years | 75% of ARF |

| Above 5 but not more than 6 years | 70% of ARF |

| Above 6 but not more than 7 years | 65% of ARF |

| Above 7 but not more than 8 years | 60% of ARF |

| Above 8 but not more than 9 years | 55% of ARF |

| Above 9 but not more than 10 years | 50% of ARF |

| More than 10 years | No rebates |

As you can see, the PARF rebate gets lower as your car gets older.

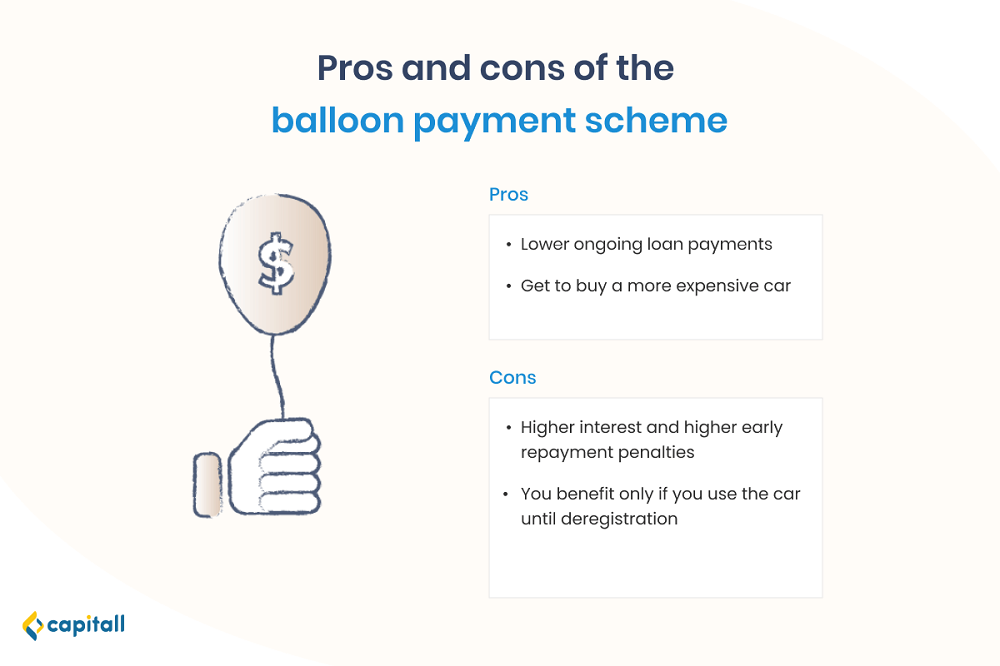

Pros And Cons Of The Balloon Payment Scheme

Now that we have seen how a balloon payment scheme works for a car loan, let us weigh the advantages and disadvantages of this scheme.

Pros

A very attractive benefit of a balloon payment scheme is that your on-going monthly loan payments are lower.

This also means you could take advantage of the scheme to finance a higher-end car that might otherwise have been beyond your means.

Cons

Higher Interest

Although you would be paying lower monthly instalments compared to that of a conventional car loan, you will be paying higher interest.

This could add up to a significant amount as the interest for a balloon payment scheme can be as much as 1% higher than that of a conventional car loan.

Higher Penalties for Early Repayment

Under a balloon payment scheme, you will be subjected to higher repayment penalties should you decide to settle your loan before the end of the tenure.

Beneficial Only If You Use The Car Until Deregistration

You also need to ask yourself if you are prepared to use the same car until it can be deregistered. This is because it is only then that you get the PARF rebate, which can then be used to offset the final large instalment that includes the PARF rebate value.

Furthermore, should you find yourself in a dire financial situation, you might have to sell the car before the end of your loan tenure. You will then have to continue forking out the high interest rate.

All in all, the balloon payment scheme might be beneficial if you are financially ready and confident of owning the car until it’s ready to be deregistered. Also, while the balloon payment scheme could help you own the car of your dreams, it is still best to be prudent and exercise good financial judgment before taking it up.

Not sure if you are financially ready for a car loan? Find out more here.